Peer-to-Peer Insurance Is Gaining Prominence In The Insurance Market

The Business Research Company’s Insurance Global Market Report 2021: COVID-19 Impact and Recovery to 2031

LONDON, GREATER LONDON, UK, January 7, 2021 /EINPresswire.com/ -- New year, new updates! Our reports have been revised for market size, forecasts, and strategies to take on 2021 after the COVID-19 impact: https://www.thebusinessresearchcompany.com/global-market-reports

Peer-to-peer insurance is gradually gaining prominence both in emerging and developed markets, driven by reduced cost of premium in emerging countries resulting from improved internet penetration in those regions. Peer-to-peer insurance is based on pooling insurance premiums of participating individuals that can be used to compensate future uncertain losses and share the left-over amount among participants. It aims to reduce premium and overhead costs as compared to traditional Insurance Providers, decrease inefficiencies and increase the transparency of businesses.

The insurance market outlook is segmented by type into life insurance, property & casualty insurance, health & medical insurance, by end user into corporate, individual, and by mode into online and offline. Subsegments covered are term life insurance, whole life insurance, variable life insurance, equity indexed life insurance, accidental death insurance, other life insurance, automobile insurance carriers, malpractice/indemnity insurance carriers, fidelity insurance carriers, mortgage guaranty insurance carriers, homeowners insurance carriers, surety insurance carriers, liability insurance carriers, hospitalization insurance, hospital daily cash benefit insurance, critical illness insurance, domiciliary insurance, other health & medical insurance.

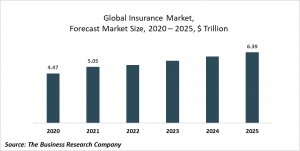

The global insurance market size is expected to grow from $4.47 trillion in 2020 to $5.05 trillion in 2021 at a compound annual growth rate (CAGR) of 12.9%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $6.39 trillion in 2025 at a CAGR of 6%.

Here Is A List Of Similar Reports By The Business Research Company:

Insurance (Providers, Brokers and Re-Insurers) Global Market Report 2020-30: Covid 19 Impact and Recovery

https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-reinsurers-global-market-report-2020-30-covid-19-impact-and-recovery

Financial Services Global Market Report 2021: COVID-19 Impact and Recovery to 2031

https://www.thebusinessresearchcompany.com/report/financial-services-global-market-report-2020-30-covid-19-impact-and-recovery

Cyber Insurance Market - By Insurance (Standalone, Packaged And Personal), By End Use (It Services, Media), Distribution (Tied Agents And Branches, Direct And Other Channels, Bancassurance), And By Region, Opportunities And Strategies – Global Forecast To 2030

https://www.thebusinessresearchcompany.com/report/cyber-insurance-market

Life Insurance Providers Global Market Report 2020-30: Covid 19 Impact and Recovery

https://www.thebusinessresearchcompany.com/report/life-insurance-providers-global-market-report

Interested to know more about The Business Research Company?

The Business Research Company is a market intelligence firm that excels in company, market, and consumer research. Located globally it has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services, chemicals, and technology.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info