Rong360 Jianpu Technology(NYSE:JT) Big Data Institute: National Mortgage Rates Drop 31BPs on Year

Jianpu Technology (NYSE:JT)

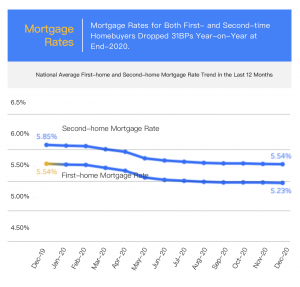

BEIJING, CHINA, January 5, 2021 /EINPresswire.com/ -- Mortgage Rates: Mortgage Rates for Both First- and Second-time Homebuyers Dropped 31BPs Year-on-Year at End-2020.According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, in December 2020 (with data in statistics collected from November 20, 2020, to December 18, 2020), the national average mortgage rate for first-time homebuyers was 5.23%, slightly decreasing by 1BP month-on-month (“MoM”); the national average mortgage rate for second-time homebuyers was 5.54%, the same as the previous month.

Compared with the data in 2019, mortgage rates for both first- and second-time homebuyers decreased by 31BPs year-on-year (“YoY”) in 2020, more than double the decrease in five-year LPR (15BPs).

Cities: 38 Cities Recorded Mortgage Rate Decreases in 2020; Suzhou’s Mortgage Rate Dropped by Nearly 100BPs.

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for December 2020 (with data in statistics collected from November 20, 2020, to December 18, 2020), 11 cities recorded an MoM increase in mortgage rates, of which the rates in Chengdu and Dongguan each increased 4BPs MoM; 16 cities saw an MoM decrease in the rates, of which Changchun and Dalian suffered significant decreases of 16BPs and 9BPs, respectively. The remaining 14 cities maintained the same levels of rates as the previous month.

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities, 38 cities recorded mortgage rate decreases in 2020. At the end of 2020, the first-home mortgage rates decreased by more than 15BPs YoY in 37 cities, of which seven cities each saw a decrease of more than 50BPs in the rates and 16 cities each saw a drop of between 30BPs and 50BPs.

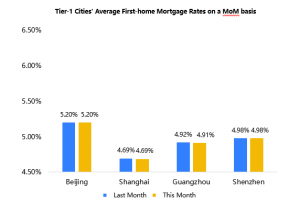

Among the tier-1 cities, mortgage rates in Beijing, Shanghai, and Shenzhen have stronger correlations with LPR, and their fluctuation ranges are also more similar to that of LPR. At the end of 2020, the YoY decreases in mortgage rates for first- and second-time homebuyers were all between 15BPs and 25BPs in these three cities. In Guangzhou, the mortgage rate for first-time homebuyers had a significant decrease of 45BPs YoY, while its second-home mortgage rate dropped by 37BPs.

The changes in mortgage rates among the second-tier cities varied by region. Suzhou saw the mortgage rate for first-time homebuyers drop rapidly from 6.12% in December 2019 to 5.18% in December 2020, representing a YoY decrease of 94BPs. In contrast, the mortgage rate for first-time homebuyers in Chengdu rose from 5.77% at the end of 2019 to the current level of 5.97%, representing a YoY increase of 20BPs. In addition, the mortgage rate in Hefei remained at a high level of 5.88% since the end of last year.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn