Rong360 Jianpu Technology(NYSE:JT) National Average Mortgage Rate Decreased by 22 BPs YoY

Rong360 Jianpu Technology (NYSE:JT)

BEIJING, BEIJING, CHINA, September 4, 2020 /EINPresswire.com/ --Mortgage Rate: National Mortgage Rate Volatility Tends to Be Flat; The Rate Posting a Decrease of 22 BPs on a Year-over-Year (YoY) Basis

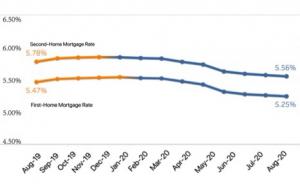

According to surveillance data from Rong360 Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, the national average mortgage rate for first-time homebuyers was 5.25% in August 2020 (with data in statistics collected from July 20, 2020 to August 18, 2020), posting a decrease of 1 basis point (BP) on a month-on-month (MoM) basis. For second-time homebuyers, the average mortgage rate was 5.56% nationwide, decreased by 2 BPs on a MoM basis.

At present, the trend of mortgage rates nationwide tends to be flat and the average rate decreased by 22 BPs compared to the same period of last year.

Cities: Mortgage Rates in 7 Cities Increased; Year-to-date Decline of 70 BPs in Suzhou

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for August 2020 (with data in statistics collected from July 20, 2020 to August 18, 2020), the average mortgage rates for first homebuyers in 16 cities decreased on a MoM basis. Among the 16 cities, Huizhou, Chongqing, Shijiazhuang and Suzhou saw a decrease of over 10 BPs. There are 18 cities maintaining the same level compared to the prior month. The number of the cities where the mortgage rate increased grew to 7. Among the 7 cities, Zhengzhou saw an increase of over 10 BPs on a MoM basis.

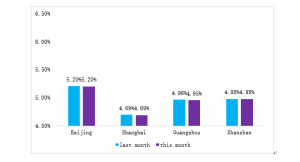

In August 2020 (with data in statistics collected from July 20, 2020 to August 18, 2020), the average mortgage rates for first-time homebuyers in Beijing, Shanghai ang Shenzhen remained unchanged; In Guangzhou, mortgage rate for first-time homebuyers decreased by 1 BP on a MoM basis, and for second-time homebuyers, the mortgage rate decreased by 2 BPs on a MoM basis.

In August 2020 (with data in statistics collected from July 20, 2020 to August 18, 2020), the mortgage rate in the most major cities remained stable with slight fluctuation. There were 12 cities where the first-home mortgage rate fluctuated over 5 BPs. Among the 12 cities, the first-home mortgage rate in Huizhou has fallen the furthest with a decline of 19 BPs on a MoM basis, while the first-home mortgage rate in Zhengzhou has risen the furthest with an increase of 17 BPs on a MoM basis. In Suzhou, the rate further decreased 10 BPs following the total decrease of 60 BPs since the beginning of this year. And the first-home mortgage rate in Kunming once again surpassed 5% with a bounce-back of 7 BPs following the increase of 60 BPs.

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

LinkedIn

Twitter

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.