Analysis of the supply conditions of commodity markets impacted by COVID-19

The macroeconomic impact of the COVID-19 pandemic continues to play out across global commodity markets, with the effects evident across entire supply chains.

BOURNE END, BUCKINGHAMSHIRE, UNITED KINGDOM, May 20, 2020 /EINPresswire.com/ -- The macroeconomic impact of the COVID-19 pandemic continues to play out across global commodity markets, with the effects evident across entire supply chains. Constraints on farm production, limited storage space, port closures and logistics bottlenecks are some of the factors defining the consequence of the pandemic. As a result, some commodity markets remain oversupplied, while others experience vast shortages.

This week, Mintec has taken a regional approach to evaluate the supply situation of several commodity markets in order to highlight those that are currently oversupplied or undersupplied. Border restrictions, labour shortages, transport and government regulations continue to impact every region and remain key factors in shaping the supply position of most commodities.

Oversupplied Markets

This section focuses on oversupplied markets in the Americas, Asia, and Europe, starting with the sugar and salmon markets in South America, the US maize market, and the EU dairy market, all experiencing a bearish price trend. It goes on to highlight the impact of the pandemic on commodity markets in India, which have particularly witnessed lower export demand since the onset of COVID-19.

Americas: Brazilian Sugar, Chilean Salmon and US Maize

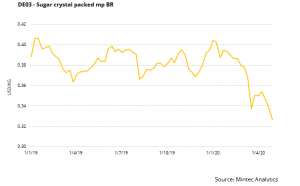

Brazilian sugar prices have followed a broad downward trend since the turn of the year, falling by 20% between January and April, to US$0.327/kg. This decline can be attributed to the coronavirus pandemic hindering export demand, while low fuel prices and weak ethanol consumption has spurred local mills to produce more sugar at the expense of ethanol. Local mills already targeted higher y-o-y sugar production for the 2020/21 season, on expectations of disrupted supply from major exporters, Thailand and India, where drought is affecting productivity. The Brazilian sugarcane harvest started on 1st April in the centre-south heartlands and 948 million tonnes of cane was harvested by mid-April, more-than doubling the yield of the same period last year. Some observers anticipate 33.1 million tonnes of Brazilian sugar in 2020/21 compared to the 26.6 million tonnes produced in the previous year. Thus, a marked uptick in global sugar demand will be required, to lend some upside price support.

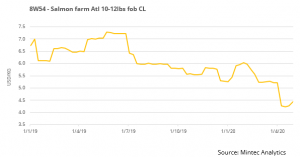

Chilean salmon prices have also fallen, losing a third of their value in the three-month period up to mid-April. Indeed, a price of US$4.2/kg observed for the week of 15th April, is the lowest price recorded in at least ten years. This was mainly due to tepid Chinese demand, although partially offset by higher exports to the Americas region. However, the FOB price for farmed salmon appears to have bottomed at US$4.2/kg, as it gained US$0.2/kg over the following fortnight. The upturn can be attributed to improved Asian demand, particularly China, which emerged from lockdown in March. Additionally, expectations of constrained supply appear to be a supporting factor. Sea lice levels remain high among the Chilean farmed salmon stock, meaning that harvest numbers could take a hit. Additionally, logistical bottlenecks are increasingly constraining transportation to domestic processing facilities and export terminals, further reducing export availability.

Lockdown measures continue to weigh on the consumption of crude oil at private, commercial and industrial levels. Due to social distancing and mandatory quarantine rules, the demand for gasoline has been negatively impacted, consequently limiting ethanol demand, due to the 10% blend rule in the US. As a result, both crude and ethanol prices have fallen to historically low levels, with crude oil prices falling into negative territory, as oversupply and lack of storage space led to producers paying buyers to store the product.

Ethanol producers have also reduced production levels and in most cases shut down plants due to the lack of profitability and loss in demand. As a result, the US maize (corn) market remains oversupplied, leading to prices as low as $122.8/MT, recorded on 28th April (the lowest level since September 2009, following a drop from the spike seen during the 2008 financial crisis). Given that a large proportion of US maize is used for ethanol production, the market has been significantly affected.

The situation indicates a long-term bearish trend for US maize, as tumbling demand for ethanol and animal feed will likely coincide with robust plantings expected for next season (2020/21). US maize production is forecast at 406.3 million tonnes, a significant increase of 59.2 million tonnes from 2019/20, as plantings rapidly outpace last year’s rain disrupted sowing. However, signs of increased Chinese demand for US commodities has eased some of the downward pressure on prices, causing prices to recover slightly in May.

Asia: Indian Onions, Cotton and Spices

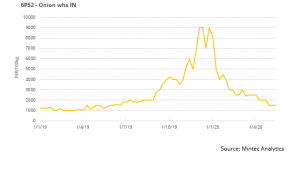

The Mintec price of Indian onions plunged by 50% between 2nd March and 13th May 2020, due to COVID-19, which has significantly impacted various sectors of the market, from auctions to consumption. In terms of production, the summer harvest is in motion and farmers are being forced to store their onions on the field. However, the current unseasonal rains in the country pose a risk to these on field onions and are thus subject to early deterioration.

The Indian onion market is vastly oversupplied, due to the reduction in domestic and export demand. Onions usually destined for foreign markets are being absorbed by the domestic market and the restrictions to auction times and vehicle numbers are making farmers panic-sell.

Indian farmers have suffered immense losses over the last year, initially as a result of the unseasonal monsoons, followed by the export ban, and trade restrictions due to the coronavirus. In the absence of governmental support, the effect of the pandemic on the Indian onion market is expected to remain for the rest of the year.

Considering the market situation, the government has begun a cross country rail service which exports onions from India to Bangladesh. This is expected to boost demand for Indian onions in the short term and halt the current bearish trajectory.

India is one of the leading exporters of cotton. However, cotton exports from the country are estimated to drop by 3% m-o-m in May, driven by the effect of the lockdown measures in place. Similarly, domestic demand has been diminishing due to limited consumer activity and the closures of “non-essential” businesses, including apparel stores. As a result, the Mintec price of Indian cotton dropped to a four-year low in April 2020 (down 20% y-o-y and 4% m-o-m), due to an oversupplied market.

Furthermore, carry-over stocks are likely to be higher than average by September 2020, depending on when the lockdown measures are lifted. The government had earlier imposed a duty on cotton exports. Therefore, the Cotton Association of India (CAI) has requested that the government reduces the export duty on cotton and cotton yarn by 5-8%, to avoid stockpiling towards September. In addition, Indian traders have not signed many new deals for exports since the imposition of the lockdown measures, thus adding to the existing stocks. They've also been taking short positions for future sales on the Multi Commodity Exchange of India Ltd (MCX), indicating a bearish price sentiment.

All these factors are expected to keep a lid on prices in the short term, but prices are likely to stabilise later due to lower plantings projected for the 2020/21 crop.

Prices of Indian spices continue to be impacted by subdued demand, particularly from overseas buyers, due to ongoing problems with transport capacities, leaving extensive supplies on the domestic market. Several local spice markets have resumed activities in the last three weeks, but some remain closed, such as the benchmark Guntur chilli market, which is in the ‘red zone’ (as reflected on the price graph above). This has encouraged some farmers to hold on to their stocks, as they are unable to sell on the local market. At the same time, labour shortages continue to hinder farm activities.

Before the implementation of the lockdown, the prices of Byadgi chilli and Teja chilli on the Guntur market fell by 24% and 35%, respectively, between January and March, also heavily impacted by a lack of demand from China. Cumin trading has now resumed in the Unjha market and prices are currently down by 17%, compared to January. On the NCDEX, where trading continues, Turmeric prices have declined by 22% since January and coriander prices are down by 25%.

Europe: Dairy

The European dairy market continues to be driven by the excess supply and subdued demand, as a result of the ongoing pandemic. Consequently, the Mintec price of European milk fell by 5% in the first two weeks of May compared to the last two weeks of April. The gradual easing of lockdown measures across Europe are expected to alleviate the price pressure experienced in the dairy market, but the effect is likely to be staggered.

The oversupply of milk across Europe, primarily due to limited demand from the food service sector amid shop, restaurant and school closures, means it will take some time for the market to recover from the impact of the outbreak. The excess supply is expected to continue to outweigh the slump in demand, which has fallen by 7.8% y-o-y in May.

Furthermore, feed costs are currently low due to the abundant supply of ingredients such as maize, and this is likely to continue in the short term, thus encouraging milk production.

The bearish price trend seen in the dairy market has led to governmental interventions, such as the opening of Private Storage Aids (PSA), which appear to have reduced supplies of milk products in the short term. However, the measures aimed at limiting the surplus stocks are not expected to significantly alleviate the pressure on prices, as various countries across Europe face different timelines in easing lockdown measures. Countries are also making choices around managing health system overloads and reducing the economic impact of the pandemic, which will mean a varied rate of demand recovery.

In addition, milk prices will remain heavily impacted by the stocks of other milk products such as SMP, butter and cheese, until there are clear signs of a considerable rise in milk demand across Europe.

Undersupplied Markets

This section focuses on undersupplied commodities markets in the Americas, Asia and Europe. COVID-19 has created commodity shortages across the world, with transportation difficulties and shipping delays causing bullish price sentiments across specific markets.

Americas: US Grains and Spices

Due to limited ethanol production, the availability of dried distillers grains with solubles (DDGS – a by-product of ethanol) in the US dropped significantly, causing prices to spike from the end of March, up 36.7% between 18th March and 8th April - the highest level in six years, at $225.97/MT. As a result, some animal feed producers started to switch to other animal feed alternatives such as soyabean meal, consequently weighing on DDGS prices. As of 6th May, the US Kansas DDGS price was down 17%, compared to the peak on 8th April, as demand falls.

The delays in Indian spice shipments are causing shortages in export markets and supporting price increases. In the US, prices for Indian chillies have skyrocketed by over 20% since mid-March, the cumin price is up by 33% and the price of turmeric has strengthened by 23% over the same period, according to Mintec data.

Asia: Chinese Cotton

The Chinese cotton market is currently undersupplied due to reduced imports from the US. The US is the largest exporter of cotton to China, and trade disruptions due to the ongoing pandemic resulted in low exports to the Chinese market. However, demand remained subdued due to the lockdown measures in China, leading to a bearish price trend between January to March.

With the lifting of China’s lockdown measures in April, consumer demand resumed, consequently, supporting cotton prices. As a result, Chinese cotton prices were up 8% in the first two weeks of May compared to the same period in April.

In addition, the coronavirus outbreak has aggravated the trade tension between the US and China. The US recently threatened to impose additional tariffs on Chinese imports, thus, a retaliation is expected from China. This raises the uncertainty of cotton supply on the Chinese market and is likely to support prices in the short term.

Europe: Spanish Lettuce

The Mintec price of Spanish lettuce increased by 39% between 4th March and 6th May 2020, as a result of growing demand due to COVID-19. Similar bullish price movements have been observed in Italy, France and Germany.

Spain, the world’s largest exporter of lettuce has seen higher demand for its lettuce both domestically and from other parts of Europe, since the beginning of the lockdown restrictions. In addition, expectations of lower production, following the impact of extreme weather conditions in key Spanish growing regions earlier in the year is creating tightness in the Spanish lettuce market.

Conclusion

As the impact of COVID-19 on commodity markets lingers, logistical issues, delayed production and limited exports continue to reflect on price movements. Hence, it remains essential to stay ahead of market fundamentals, in order to mitigate risks associated with supply and demand imbalances.

This week’s analysis provides a snapshot of the supply state of selected commodities, highlighting that a considerable recovery in demand will be required, to see a noteworthy reversal in the bullish price trends seen in oversupplied commodity markets. While lockdown measures are being eased in more countries across the globe, the economic impact of the pandemic will be key to determining the rate at which demand will improve.

For the undersupplied commodity markets, improved access to international markets, through the easing of border restrictions should provide some price relief, but a high level of uncertainty remains.

Governmental legislation and support remain vital for commodity markets, as governments have the ability, resource and capacity to shift market prices by creating trade routes which have previously seemed unviable. For example, the export of Indian onions to Bangladesh by rail is a unique transport mode and the first of its kind, which is expected to stabilise Indian onion prices.

Mintec continues to publish regular updates on the impact of the coronavirus, to help commodity market participants stay on top of market trends and dynamics.

ENDS

For regular updates on commodity prices visit our Market Insight page.

Analysts are available for comment. Please contact the Mintec Media Office:

Email: pr@mintecglobal.com

To gain access to our latest commodity prices and expert analysis on developments in your industry, please connect with us on:

Mintecglobal.com | LinkedIn | Twitter

About Mintec

Mintec enables the world's largest food brands to implement more efficient and sustainable procurement strategies through its SaaS platform. Mintec Analytics, delivers market prices and analysis for more than 14,000 food ingredients and associated commodity materials. Our data and tools empower our customers to understand supplier prices better, analyse their spend in greater detail and negotiate more confidently with suppliers. Ensuring they are best placed to reduce costs, manage risk and increase their efficiency, helping them to maximise their margins.

David Bateman

Mintec

+44 1628 642762

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Data-driven insight into food commodity prices