COVID 19: Analysis of Food Commodity Price Indices

Mintec analyses the impact of COVID-19 on a range of commodity categories, highlighting the price movements seen since the beginning of the year.

ROMFORD, ESSEX, UNITED KINGDOM, May 12, 2020 /EINPresswire.com/ -- COVID 19: Analysis of Commodity Price Indices

Despite some countries beginning to ease lockdown measures, the COVID-19 pandemic continues to impact commodity markets with varying degrees, and beyond the pandemic, market fundamentals remain vital for monitoring price movements.

This week, Mintec analyses the impact of COVID-19 on a range of commodity categories, highlighting the price movements seen since the beginning of the year. The analysis also provides insight on the key supply, demand and trade dynamics underpinning the price movements.

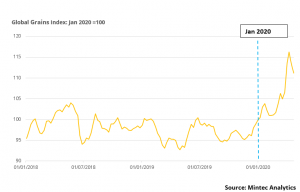

Global Grains Index (Maize/Corn, Rice and Wheat)

The grains index has charted a bullish path since January. As of 8th April, grain prices had increased by 17.5% since the turn of the year, reaching the highest levels recorded in over six years. Since then, the index has decreased, with significant downward pressure experienced in the rice and maize markets, which fell respectively by 6.3% between 8th to 15th April and 3.6% between 8th to 22nd April.

CBOT maize (corn) prices are rapidly decelerating, pressured by the impact of the coronavirus on ethanol demand. Due to the lockdown measures, fuel consumption deteriorated, and ethanol plants closed, thus impacting maize demand. In addition, above-average plantings scheduled for the 2020/21 season, coupled with projected ample ending stocks, provide further downward pressure. As of 22nd April, CBOT maize prices were 18% cheaper than they were at the beginning of the year.

For rice, strong demand and tight domestic supplies are supporting robust prices. As COVID-19 continued to spread across the globe, consumers have increased stockpiling of non-perishable goods such as rice, pasta and flour. As a result, prices have been supported by the panic buying, amid supply related to drought conditions in Thailand. However, from mid-April Thai rice prices fell sharply, due to weak demand, as buyers showed interest in alternative markets, such as India after the government announced the resumption of rice exports (exports ban initially put in place to ensure domestic supply amid the COVID-19 pandemic). According to the USDA, rice exports for this year, as at 19th April were down 40% compared to the same period last year.

Because of the panic buying, and export restrictions put in place by top exporters in the Black Sea region, the Euronext wheat price rose by 2.6% m-o-m in April. However, as of 22nd April, European wheat prices were 1.3% lower than 1st January. These prices edged lower on the back of favourable rainfall easing concerns over potential crop damage due to dry conditions in Western Europe during the past month.

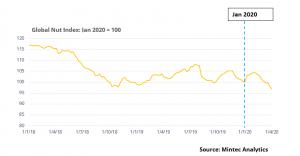

Global Nut Index (Almonds, Hazelnuts, Pecans, Peanuts and Cashew)

Prices in the nut category have softened by 4% since the beginning of the year. The decline has been mainly driven by falling almond prices, down 21% since 1st January. The main drivers were the expectations of a very good 2020 harvest in California, the largest almond producer, following ideal weather conditions and an increase in planted area. This is despite robust global demand for almonds amid the pandemic. Hazelnut prices rose very early in January but continue trending down with the weak Turkish lira being a key factor. The currency has fallen below 7:1 against the USD, pressurised by a strengthening USD and concerns over Turkey’s public finances due to COVID-19. US pecan prices have increased marginally by 3% since the start of the year. Argentinian peanut prices in the EU have firmed by 10% as stocks in Europe remain tight, following aflatoxin issues in the US crop and consumers stocking up on cheap and protein-rich peanuts. Cashew prices in Vietnam continue declining, down 9% since the beginning of the year.

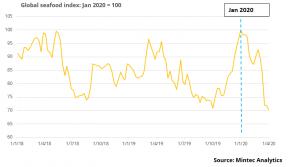

Global Seafood index (Alaska pollock, Tuna, Salmon and Prawns)

The effects of the coronavirus pandemic on seafood prices is reflected on the seafood index, which has fallen by 30 points since the turn of the year.

The Thai skipjack price rallied in 2020 on firm demand and constrained supply due to social isolation amid the coronavirus outbreak. For the quarter ending April 2020, the average price increased by 48% q-o-q, albeit from a low floor. China, a major skipjack importer and processor, emerged from lockdown in late March. China re-exports significant volumes of frozen skipjack loins to European canneries and European demand for canned tuna has been particularly robust due to the rise in home consumption, as opposed to restaurants and other eateries.

The duel impacts of a weak currency and coronavirus-depleted global demand began to weigh on Norwegian salmon export prices and the price has continued to weaken through the first two quarters thereafter. Between February and April, the average price fell by 6% y-o-y and by 10% q-o-q.

Indian prawn prices have fallen by 26% since 1st January to $3.14/kg. For the period ending 30th April, the average price of $3.68/kg was 8% lower than the same period in the previous year. Thin Chinese demand has been the key determinant, as China remains the world’s top importer. Given that China entered lockdown in January, the lack of orders from elsewhere resulted in a supply glut, which weighed on global prawn prices.

Alaska pollock prices are almost 25% lower than at the start of the year. Lack of Chinese demand was again a major factor, as China is a major importer of Russian fish. However, with China now out of national lockdown, orders are seen to be improving and Chinese processors were reportedly operating at around 80% of capacity by late March with some plants claiming to be back running at full capacity.

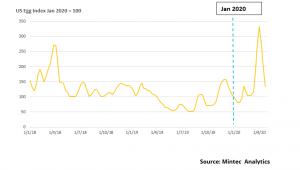

US Egg Index

US egg market prices have exhibited volatile movements, since the outbreak of COVID-19. The US egg index increased throughout March 2020 compared to February (prices up 47% m-o-m), as US consumers scrambled to stock-up on staple foods due to the coronavirus crisis. Furthermore, the increase in the egg index was supported by food retailers’ demand, as they tried to backfill store shelves which were laid bare by the recent wave of panic buying by consumers. The Egg index peaked in the first week of April on thin inventory levels. During the same period, retail orders increased six-fold in anticipation of firm consumer Easter demand.

Mintec egg prices plummeted by 60% between the first and third week of April 2020, as Easter demand quickly fell away. The hoarding instinct seen during the initial phase of the COVID-19 impact has eased considerably, and shoppers see adequate supplies in most stores across the country. In addition, demand from retail businesses has also slowed as most retailers made good progress towards keeping shelves stocked. Foodservice demand remains limited for now but is showing signs of revival as the US cautiously emerges from lockdown.

Global Fruit and Vegetables index (Apple, Orange, Lettuce, Broccoli, Onion, Potatoes and Avocado)

The fruit and vegetables index has mainly moved upwards since the outbreak of COVID-19. Initially, rising demand for fresh produce supported higher prices, with fruits sought after due to the nutritional benefits. Since then, there’s been a significant reduction in demand for fruits and vegetables from the foodservice and catering industries.

Consequently, thin demand from the food service industries has resulted in more downward pressure from late March.

The Indian onion price was a big contributor to the downward pressure. The Indian onion market is currently oversupplied, and the reduction in exports to foreign markets due to COVID-19 has flooded the domestic market. Indian onion prices are further pressured by a 30-40% reduction in onion demand due to the closure of restaurants and roadside eateries in response to the COVID-19 outbreak.

In contrast to the Indian onion market, the Chinese potato price has remained firm, with the gradual reopening of the foodservice sector and strong retail demand. Retail demand for potatoes in China has persisted throughout the COVID-19 period, with consumers hoarding the produce due to its health benefits. Furthermore, Chinese ports currently face no closures, and this is expected to increase the export demand for Chinese potatoes.

Conclusion

The effect of the coronavirus pandemic on the food industry is characterised by contrasting dynamics, which are very often region and product dependent. In some markets, supply may be plentiful at the upstream level of farming and fishing, but the market remains tight and prices firm due to logistical factors, such as port closures or restricted movement. Markets that experienced panic-buying behaviour in Q1 2020, are slowly resetting, as some of the initial concerns dissipate. However, it remains to be seen whether there will be a prolonged shift in some of the market fundamentals, as countries emerge from social isolation. For instance, some markets, such as hospitality and catering may remain depressed for many months after official restrictions are lifted, if consumer confidence remains low.

About Mintec

Mintec enables the world's largest food brands to implement more efficient and sustainable procurement strategies through its SaaS platform. Mintec Analytics, delivers market prices and analysis for more than 14,000 food ingredients and associated commodity materials. Our data and tools empower our customers to understand supplier prices better, analyse their spend in greater detail and negotiate more confidently with suppliers. Ensuring they are best placed to reduce costs, manage risk and increase their efficiency, helping them to maximise their margins.

David Bateman

Mintec

+447970668470

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Data-driven insight into food commodity prices