ALG Provides Updated 2020 New Vehicle Sales Forecast Based on Projected Short-Term and Long-Term Impact of COVID-19

Reduces Residual Values to Reflect Slowdown in Latest Release

SANTA MONICA, Calif., March 16, 2020 (GLOBE NEWSWIRE) -- ALG, a subsidiary of TrueCar, and the industry benchmark for determining the future resale value of a vehicle, is providing an updated 2020 new vehicle sales forecast to account for the quickly evolving Coronavirus pandemic and the latest economic outlook.

ALG projects that in a quick recovery scenario, where the economy and auto industry recover by the end of April 2020 back to levels prior to COVID-19 disruption, new vehicle sales will reach 16.4 million, down -500,000 vehicles or -2.9% from ALG’s initial 2020 forecast and down -3.8% from 2019 sales.

In a scenario where COVID-19 is prolonged with a longer-term economic slowdown, ALG forecasts that new light vehicles sales will reach 14.5 million, down -2.4 million or -14.2% from ALG’s initial 2020 forecast and down -14.9% from 2019 sales.

“In the rapidly moving, highly volatile global economic environment caused by the COVID-19 pandemic, we believe it’s prudent to provide a revised range of auto industry projections to new vehicle sales for 2020. The range is based on various scenarios provided by expert third party forecasts of macro-economic impacts from the Coronavirus outbreak,” said Eric Lyman, Chief Industry Analyst for ALG, a subsidiary of TrueCar. “A quick recovery by the end of April would lead to roughly half a million lost sales, while a prolonged slow down through the end of the year would result in a nearly 15% year-over-year sales decline in 2020. While forecasts are changing day to day, our current likely scenario has new vehicle sales for 2020 landing in the mid 15M unit range.”

ALG is also reducing residual values in its latest Residual Value Book. This update is based off current third-party economic outlooks in COVID-19 impact and other key factors such as the stock market declines and drops in oil futures.

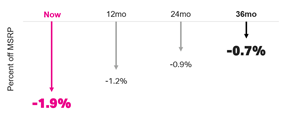

“Short term market volatility does not necessarily translate into long term changes,” said Morgan Hansen, VP of Data Science at ALG, a subsidiary of TrueCar. “While ALG expects a short term drop of roughly 2 percentage points of MSRP in wholesale used market values, our benchmark 36 month forecast only expects a decline of 0.7 ppts of MSRP. These values are based on current expert third party macro-economic forecasts that put the probability of prolonged economic downturn risk at 50%.”

-

Key impacts of residual value reductions are COVID-19, stock market performance, and drops in oil futures

- COVID-19 will have impacts on both vehicle inventory availability and consumer confidence, affecting supply and demand.

- COVID-19 will have immediate short term impacts due to reduced income and reduced commerce in general.

- In the extreme case, COVID-19 could also halt sales in the short term if auction houses and transportation companies have temporary shutdowns, but this is not reflected in the current ALG longer term outlooks.

- Long term, COVID-19 and poor quarterly results will most likely result in higher unemployment rates through 2020 and into 2021. Prolonged bear markets generally lead to more layoffs.

- Low oil prices have traditionally been good for the economy, but increases in domestic oil production and extremely low prices are detrimental to the US economy in the short term.

- Government intervention strategies and election results will impact the US economy throughout 2020 regardless of how quickly COVID-19 recedes.

- COVID-19 will have impacts on both vehicle inventory availability and consumer confidence, affecting supply and demand.

-

Change in Percent of MSRP

- The impact varies by segment and term of the forecast. As probability increases, the impacts are greater in the shorter term with positive recovery forecasted for the long-term.

ALG will update its forecasts in response to major new developments.

About ALG

Founded in 1964 and headquartered in Santa Monica, California, ALG is an industry authority on automotive residual value projections in both the United States and Canada. By analyzing nearly 2,500 vehicle trims each year to assess residual value, ALG provides auto industry and financial services clients with market industry insights, residual value forecasts, consulting and vehicle portfolio management and risk services. ALG is a wholly-owned subsidiary of TrueCar, Inc., a digital automotive marketplace that provides comprehensive pricing transparency about what other people paid for their cars. ALG has been publishing residual values for all cars, trucks and SUVs in the U.S. for over 55 years and in Canada since 1981.

About TrueCar

TrueCar is a leading automotive digital marketplace that enables car buyers to connect to our network of 16,500 Certified Dealers. We are building the industry's most personalized and efficient car buying experience as we seek to bring more of the purchasing process online. Consumers who visit our marketplace will find a suite of vehicle discovery tools, price ratings and market context on new and used cars -- all with a clear view of what's a great deal. When they are ready, TrueCar will enable them to connect with a local Certified Dealer who shares in our belief that truth, transparency and fairness are the foundation of a great car buying experience. As part of our marketplace, TrueCar powers car-buying programs for over 250 leading brands, including AARP, Sam’s Club, and American Express. Nearly half of all new-car buyers engage with TrueCar powered sites, where they buy smarter and drive happier. TrueCar is headquartered in Santa Monica, California, with offices in Austin, Texas and Boston, Massachusetts.

For more information, please visit www.truecar.com, and follow us on Facebook or Twitter. TrueCar media line: +1-844-469-8442 (US toll-free) | Email: pr@truecar.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0691639-a73e-45ea-bd7b-5367268ef63f

https://www.globenewswire.com/NewsRoom/AttachmentNg/f832b84b-33d9-488f-9300-4ed531903fea

TrueCar and ALG PR Contact: Shadee Malekafzali shadee@truecar.com 424.258.8694