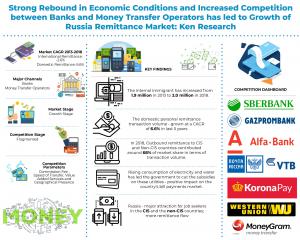

Russia International Remittance Market is expected to Post Transaction Volume around USD 90 Billion by Year Ending 2023.

• Increased penetration of digital technologies is expected to create trends for virtual currencies, contactless payment modes and mobile financials.

• Adoption of block chain and crypto currency will have far-reaching influence on remittance market as R&D has been carried out by major traditional banks, FinTech and other financial companies.

• Growth in banked population of Russia will further increase new opportunities and penetration of banking services.

Ukraine Ban Russian Remittance Services: Over the years, Ukraine has been among the top remittance corridors for Russia and major outbound contributors for Russia international remittance market. In 2016, Ukraine government banned banking and money transfer services from Russia due to war between Kremlin’s and Ukraine. This has increased the flow of remittance from Russia to Ukraine through non-official channels, as almost 3.2 million Ukrainians moved to Russia during 2002-2017. Earlier half of remittance from Russia to Ukraine was transferred through Blizko, Anelik, Zolotaya Korona, Leader, Unistream, Colibri, and Contact which are now declared illegal in Ukraine. Ban will affect the international remittance market of Russia and Ukraine in forecasted period.

For information click on the below mentioned link:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/russia-remittance-and-bill-payments-market/257747-93.html

Growing Banked Population: In 2018, almost 67% of population has a personal bank account which has increased the use of banking services for both remittance and bill payments. Hence, increasing penetration of banking services in rural parts of the countries is helping Russians to shift from traditional remittance channel such as post office and MTOs towards banking channels which are more secure and provide services at low commission charges. It expected that banking population will increase further in the country in near future with increasing penetration of banks.

Partnerships between Remittance Channels: The growing partnerships between major banks and money transfer operators is strengthening the remittance market in the country and is expected to provide convenience and options for remittance to customers. But with strict migrations policies and limitations on transfer amounts will provide hinders to the growth of remittance market in the future.

Digital Advancements in the Financial Services Segment: Major digital trends are revolutionizing the mobile financial services in the country majorly through virtual currencies, wearable technologies and biometrics and are expected to have major impact on Russia market. In future, block chain and crypto currency is expected to have a large impact on the global remittance market, particularly in countries such as the Russia which will augment the remittance market. NFC and contactless payment system has already gazed attention among the customers in recent times and is expected to increase its penetration in Russia market.

Analysts at Ken Research in their latest publication “Russia Remittance and Bill Payments Market Outlook to 2023 (Second Edition) – By Domestic Remittance Banking & Non Banking Channels; International Remittance Flow Corridors and Channel; and Bill Payment Segment” believe that pawnshops in Russia can play a major part in expansion plans for money transfer operators. Fast changing technology and mode of payments will require quick adoptions by the major players and small players. A failure to do so will lead to their eventual disappearance as new service models continue to emerge in the Russia. This will help the sector to register positive CAGR of 5.0% during the period 2018-2023 in terms of transaction volume in International Remittance market.

Key Segments Covered:

International Remittance Market

By Flow Type

• Inbound

• Outbound

By Individuals

• Residents

• Non-Residents

By Major Flow Corridors

• CIS (Kazakhstan, Uzbekistan, Tajikistan, Kyrgyzstan, Ukraine and Others)

• Non-CIS (Switzerland, Latvia, USA, UK, Germany and Others)

By Remittance Channels

• Banks

• Non Banks

By Payout Mode

• Cash

• Non-Cash/Electronic Transfer

By Channels

• Bank

• Non-Banks

Domestic Remittance Market

By Remittance Channels

• Banks

• Non Banks

By Major Flow Corridors

• Central Russian Federal District

• Volga Federal District

• North-western Federal District

Bill Payments Market

By Mode of Payment

• Offline

• Online

Method of Payment

• Cash

• Credit / Debit Cards / E-Wallets

• Direct Bank Debits and Transfers

Key Target Audience:

• Money Transfer Operators

• Banks

• Pawnshops/ Pawnbrokers

• Bill Payment Companies

• M-Wallets

• Mobile Money Companies

• Central Bank

• Investors and PE Firms

• Convenience Stores

Time Period Captured in the Report:

• Historical Period – 2013-2018

• Forecast Period – 2019-2024

Companies Covered:

Major Bank Channel in Russia:

• Sberbank

• VTB Bank

• Gazprombank

• Alfa Bank

Major Non-Banking Channel in Russia:

• Russian Post

• Koronapay

• Unistream

• CONTACT(QIWI)

• Money Gram

• Western Union

Key Topics Covered in the Report

• Russia Domestic Remittance Market Size (2013-2018)

• Russia Bill Payments Market Size (2013-2018)

• Russia International Remittance Market Size (2013-2018)

• Russia Remittance and Bill Payments Market Overview

• Russia Remittance and Bill Payments Market Ecosystem

• Russia Remittance and Bill payments Market Segmentation (2013-2018)

• Trends and developments

• Comparative Landscape including Strength and Weakness of the major Remittance and Bill Payments players

• Company Profiles of Major Players

• Future Outlook and Projections of Russia Domestic Remittance Market (2018-2023E)

• Future Outlook and Projections of Russia Bill Payments Markets (2018-2023E)

• Future Outlook and Projections of Russia International Remittance Markets (2018-2023E)

• Analyst Recommendation

For information click on the below mentioned link:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/russia-remittance-and-bill-payments-market/257747-93.html

Related Reports

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/singapore-remittance-payments-market/242385-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/philippines-remittance-payments-market/204157-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/europe-international-remittance-market/194013-93.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91 90153 78249

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.