Rong360 Jianpu Technology (NYSE:JT) Big Data Institute: Mortgage Rates Have Declined Nationwide in the New Year

Mortgage rates: 2020 mortgage rates have declined at the beginning of the new year; mortgage rates for first-time homebuyers declined to 5.51% nationwide

Jianpu Technology (NYSE:JT)

BEIJING, CHINA, February 7, 2020 /EINPresswire.com/ -- Mortgage rates: 2020 mortgage rates have declined at the beginning of the new year; mortgage rates for first-time homebuyers declined to 5.51% nationwideThe monitoring data based on 35 key cities released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows the average mortgage rate was 5.51% nationwide for first-time homebuyers in January 2020. As demonstrated by data collected from December 20, 2019 to January 19, 2020; posting a decrease of 1 basis points (BP) on a month-on-month (MoM) basis. And 71 BP have been added over the five-year loan prime rate (LPR). Additionally, the average mortgage rate for second-time homebuyers was 5.82%, posting a decrease of 2BP on a MoM basis. Specifically, 102 BP have been added over the five-year LPR for second-time home buyers.

Starting in January 2020, Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute has expanded research capacity by broadening our tracking samples to 41 cities and 673 bank branches (and sub-branches). According to our bank loan rate monitoring, the average mortgage rate was 5.53% nationwide for first-time homebuyers in January 2020, and 5.84% for second-time homebuyers.

Cities: 20 cities have lowered mortgage rates for first-time homebuyers; Shanghai mortgage rate has hit a new 30-month record low

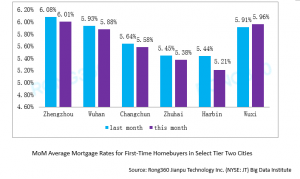

The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute show that mortgage rates for first-time homebuyers among 20 cities were lowered in January 2020. Among these cities, 7 of them posted a decrease of more than 5BP, and Harbin posted a decrease of 23 BP MoM. First-time homebuyer mortgage rates in 11 cities increased, and Wuxi showed the highest increase of 5 BP.

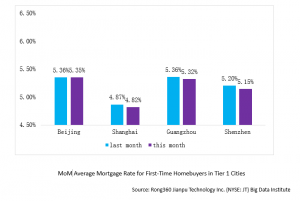

Among Tier 1 cities, Beijing, Shanghai, Guangzhou and Shenzhen all saw mortgage rates for first-time homebuyers drop in January 2020. Month-over-month rates for Beijing decreased 1BP again this month and 4BP in Guangzhou. The average mortgage rate decreased 5BP in both Shanghai and Shenzhen. After the decrease, the mortgage rate for first-time homebuyers was 4.82%, a new record low for the last two-and-a-half years in Shanghai.

Among Tier 2 cities, mortgage rates for first-time homebuyers decreased more than 5BP in 5 cities. The mortgage rate decreased 23BP MoM to 5.21% in Harbin. Among the cities whose mortgage rates increased, Wuxi showed the most prominent rate rise of 5 BP, while other cities were not as prominent.

Di Wang

Jianpu Technology

10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn