Iceland: Staff Concluding Statement of the 2019 Article IV Mission

November 11, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

After years of robust growth, economic growth has weakened substantially. Supply disruptions in tourism, the engine of growth over the past five years, and the associated increase in uncertainty has triggered a drop in domestic demand and an increase in unemployment. A moderate recovery is expected to start next year, but the economy remains fragile, and significant downside risks weigh on the outlook.

The authorities’ swift policy response, with fiscal relaxation and monetary easing, has been appropriate. It has stabilized expectations and cushioned the effects of the tourism shock, averting a deeper growth slowdown. Policy space—rebuilt in the decade following the crisis—is available, and further easing would be warranted if risks materialize.

Ongoing reforms are strengthening the financial sector oversight architecture and the country’s AML/CFT framework. Boosting human capital and productivity, strengthening transparency of systemically important unlisted companies, and protecting the environmental sustainability of traditional economic sectors could help support long-term growth.

1. After six years of robust growth, Iceland’s economy is experiencing a significant slowdown. One of Iceland’s largest airlines has ceased to exist, reflecting high operating costs and intense global competition. This and the global grounding of the Boeing 737 Max have caused a significant loss of tourist arrivals. The decline in tourism has triggered a drop in domestic demand and increased unemployment.

2. A swift policy response has softened the impact on the economy. The government has eased fiscal policy, providing a stimulus in 2019 and lowering targeted near- and medium-term general government balances. The Central Bank of Iceland (CBI) has reduced policy interest rates by 150 basis points since March 2019. The April collective wage agreement—completed with active government involvement—has moderated average wage growth for the next three years, dampening the impact of the adverse tourism shock on employment.

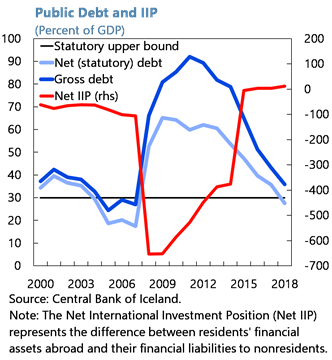

3. Solid economic fundamentals and policy credibility—rebuilt in the decade following the crisis—have allowed the economy to weather the downturn. Public and private balance sheets are comfortable. Fiscal surpluses have contributed to the rapid decline in public debt. The current account is in surplus, net external assets are positive, and international reserves are ample. Inflation expectations are at the CBI’s target. Banks’ balance sheets show high capital adequacy and strong liquidity ratios.

4. The economy is poised to recover. The recent monetary policy easing is expected to help support domestic demand. Budgeted public spending will contribute to growth in 2020 and the medium term. A partial recovery in tourism is also projected to drive near-term growth. IMF staff projects growth to recover to about 2 percent over the medium term.

5. And Iceland’s social contract assures inclusive growth. The recent collective bargaining agreement —completed in the wake of WOW Air’s collapse—demonstrates that in the face of large adverse shocks, Iceland’s wage-setting process can be swift and flexible and able to prevent large job losses. Delivering one of the lowest gender wage gaps and employment gaps for disadvantaged groups and one of the highest labor shares in income among peer countries, Iceland’s labor market arrangements are among the most inclusive in advanced economies. The introduction of a link between the growth of wages and GDP per capita is a promising way to align pay with productivity developments.

6. Nonetheless, important policy challenges remain on the authorities’ agenda.

- Managing precarious external risks to the outlook. Negative spillovers from global risks, including the UK’s still uncertain Brexit, rising protectionism and retreat from multilateralism, weaker-than-expected global and European growth, and further worsening in tourism activity, for instance if capacity constraints due to the grounding of Boeing 737 Max remain in place longer, could tilt the economy into a recession.

- Continued strengthening of financial sector oversight, especially as Iceland fully reintegrates into global financial markets. The ongoing merger of the CBI and the financial supervisory authority (FME) is an important institutional reform that should achieve greater efficiency, operational independence, and powers in financial oversight. Iceland’s recent designation (grey-listing) by the Financial Action Task Force (FATF) as a jurisdiction with strategic deficiencies in anti-money laundering and combating the financing of terrorism (AML/CFT) increases the urgency to ensure effective implementation of the AML/CFT framework.

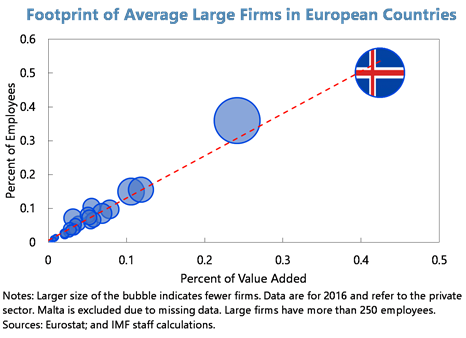

- Upgrading Iceland’s growth engine. The economy needs greater employment in high-skilled jobs and a boost in productivity growth. As a small economy, Iceland’s dependence on a few sectors and companies makes it vulnerable to shocks, with risks harder to monitor where corporate transparency is insufficient. Iceland’s natural resources need to be preserved to support traditional sectors.

7. Policy space is available if needed. With output close to potential, there is no urgency for further policy easing. Should risks materialize, fiscal and monetary policy space built through prudent macroeconomic management over the years permits further discretionary policy action.

- Fiscal policy. The authorities’ fiscal plan is appropriate in view of the weakening of the economy and is projected to lower public debt to its low precrisis level over the medium term. Iceland’s fiscal framework has helped gain credibility and fiscal space, for instance to accommodate lower revenues and higher social spending if risks materialize. Refining the implementation of the fiscal framework could make discretionary fiscal actions more effective in smoothing upturns and downturns of the economy. In the medium-term, completing the planned government spending reviews could reveal options to reorient spending to areas with high growth contribution, thereby complementing the recently announced growth- and progressivity-enhancing tax reform. Active management of the public sector balance sheet should continue to consolidate gains, including by lowering public debt service costs further.

- Monetary policy. The CBI’s policy response has eased households’ and firms’ debt service costs and has supported domestic demand, while inflation expectations remain near the target. Further relaxation is not needed unless economic conditions deteriorate significantly, and inflation expectations fall well below target. Confidence in the monetary policy framework is solid. The CPI has worked well as a monetary policy target. The CBI’s foreign exchange arrangement has preserved exchange rate flexibility and maintained adequate international reserve buffers.

- Macroprudential policy. Given still elevated real estate prices and favorable financing conditions, macroprudential policies in train are helping to preserve buffers for managing financial stability risks. Looking forward, the macroprudential policy toolkit could be expanded to include loan-to-value limits for commercial real estate loans and income-based measures to contain potential risks in the loan portfolio over the medium term.

8. The merger of the CBI and FME should strengthen the financial sector oversight architecture. The committees on financial supervision, financial stability, and monetary policies should provide for an integrated approach to policymaking, enhancing the synergies between the oversight, lender-of-last resort, and resolution functions, while strengthening policy accountability. While recognizing that full integration in practice will take time, the framework should be implemented as swiftly as possible, and the new internal organization should bolster the technical capacity and resource adequacy for supervisory work. A planned review of the framework in 2021 would be an opportunity to strengthen its effectiveness if necessary.

9. Swift actions are needed to complete all recommendations of the FATF and mitigate reputational risks to Iceland. Since 2018, the authorities have taken important steps to strengthen the AML/CFT framework and enhance its overall effectiveness. They have adopted a number of legislative and other reforms to improve domestic coordination and cooperation and increase resources allocated to combating money laundering and terrorism financing, while recognizing that further efforts are needed to improve effectiveness. Despite the recent grey-listing, Iceland has not experienced significant pressures in financial markets or payments so far, but continued vigilance is required. The authorities and banks preemptively secured open channels of communication with domestic and foreign counterparties to provide updates on AML/CFT progress and avert possible adverse effects of the grey-listing. Broader public awareness of the potential impact of the grey-listing for companies and households is also needed.

10. Structural reforms could reignite Iceland’s growth potential. Securing stable long-term growth and high living standards going forward requires efforts in areas such as: (i) building stronger human capital through well-targeted education reforms, focusing on teacher training and professional development and helping immigrant children integrate and reach their potential; (ii) further strengthening transparency of unlisted companies with large impact on the Icelandic economy to help protect the integrity and reputation of Iceland’s business environment; and (iii) carrying out well articulated public policy strategies to preserve the marine and tourism endowments of the country and support the sustainability of Iceland’s traditional economic activities.

The IMF team is grateful for the generous hospitality of the Icelandic authorities and would like to thank the Prime Minister and all interlocutors in the Prime Minister’s Office, the Central Bank of Iceland, the Ministry of Finance and Economy, the Ministry of Justice, the Ministry of Fisheries and Agriculture, the Ministry of Education and Culture, the Ministry of Tourism, Industry and Innovation, the Financial Supervisory Authority, and the private sector for constructive and fruitful discussions.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Meera Louis

Phone: +1 202 623-7100Email: MEDIA@IMF.org