Investor Confidence Wanes in October as Worries about the U.S. Economy Drive Sentiment Away from Stocks

Declining Spectrem Confidence Indices Reveal Concerns Over Political and Global Challenges Despite Near-Record Market Highs

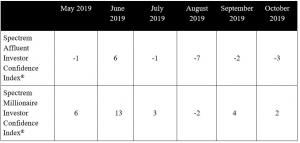

CHICAGO, IL, USA, November 1, 2019 /EINPresswire.com/ -- While October marked another strong month for the stock market, investor confidence waned slightly amid increasing concerns over global and political issues facing the U.S., according to the November edition of Spectrem’s High Net Worth Insights Journal.The monthly Spectrem Millionaire Investor Confidence Index (SMICI®), which tracks changes in investment sentiment among households with $1 MM or more in investable assets, retreated by 2 points from 4 to 2 in October after climbing out of negative territory in September. The Spectrem Affluent Investor Confidence Index (SAICI®), which measures investment sentiment among the 17 MM households in America with more than $500,000 in investable assets, lost 1 point from -2 to -3, remaining in negative territory for the fourth month in a row. The last time the SAICI was in negative range for four consecutive months was back in 2012-13 when it ran negative for 10 months straight.

The October survey was fielded Oct. 18-21, 2019, when impeachment conversations dominated the public conversation, and matters related to Syria and Ukraine weighed heavily on the minds of investors. During the survey fielding period, protracted trade negotiations between the United States and China appeared stuck, and the E.U. faced growing prospects for a hard Brexit. At the same time, the three major stock indices all sat within a few percentage points of record highs, and both the NASDAQ and S&P 500 brushed up against their highest levels ever.

Often, investors let the economy set their confidence levels, but in October, other factors seemed to carry greater weight. During the month, interest among all investors in individual stocks and stock mutual funds fell slightly, while cash investing intentions rose significantly. Among all investors, cash investing climbed by more than 5 percentage points, from 22.0 to 27.20, and that increase was balanced by a similar increase among both Millionaires and non-Millionaires. Individual bond investing among Millionaires rose by more than 4 percentage points, from 10.9 to 15 percent.

While the cash investing increase seemed to outweigh the decrease in stock investing, there was also a decrease in investors not investing. More people in October intended to increase asset allocations in the coming month than did so in September. Among Millionaires, those not investing fell by more than 4 points to 30.7 percent.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, improved for a second consecutive month following a steep decline in August. In October, the Outlook rose from 14.50 to 18.10, 10 points higher than it was in August, but remaining unusually low overall. The Outlook was above 20 for six straight months, from February through July of 2019.

Among the four Outlook components, the economy showed the only decrease, following a summer marked by slowing economic growth and talk of a pending recession. The overall outlook for the economy sits at -14.80 among all investors, and the only segment of investors with a positive take on the economy are investors who identify as Republicans, rating their Outlook for the economy at 25.53.

Running counter to the Outlook for the economy is the Outlook for household income, which registered a rating of 31.20, the highest rating for that component since December of 2007, which, of course, was just before the Great Recession struck.

“Investors clearly have questions and concerns about the future,” said Spectrem President George H. Walper Jr. “They may be uncertain which indicators to believe. Or, the current toxic U.S. political climate may be overshadowing their ability to focus on ongoing favorable stock market performance and economic indicators. However, with just 12 months to go until the 2020 Presidential election, investors may need to decide in the next few months whether to concentrate more on the economy than on the rhetoric.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Investor Confidence Suffers A Slow Leak

• November 2019 Index Webinar

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here