APAC Beer Market Analysis, Market Size, Share, Growth Forecast 2024 | Market Research Report by Arizton

The APAC beer market is expected to grow at a CAGR of over 4% during the period 2018–2024.

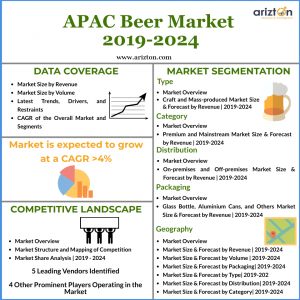

CHICAGO, IL, UNITED STATES, September 24, 2019 /EINPresswire.com/ -- Arizton's research report on the APAC beer market covers sizing and forecast, market share, industry trends, growth drivers, and vendor analysis. The market study includes insights on segmentation by type (craft beer and mass-produced beer), category (premium and mainstream), distribution (on-premise and off-premise), packaging ( glass bottles, aluminum cans, and others), and geography (Australia, Vietnam, India, South Korea, Singapore, Thailand, Taiwan, Philippines, China, Japan, and Others).

The introduction of gluten-free, low calorie, low alcohol, and non-alcoholic beers is expected to drive the growth of the APAC beer market during the forecast period. Consumers are increasingly shifting toward gluten-free beers, which are made of millet, barley malt, rye, corn, potato, rice, soybean, and sorghum. Hence, the growing innovation in flavors and preparations is likely to drive the APAC beer market.

The emergence of craft beers and microbreweries in emerging economies such as India and China is a major factor driving the demand for low-alcohol drinks and flavored beers in the APAC region. Although the craft beer market in APAC is at a nascent stage, the willingness of consumers to pay a high price for innovative drinks is supporting the growth of the market. The craft beer market share in APAC accounted for approximately 5% of the total market in the region. Also, the growing number of microbreweries across the area is supporting APAC beer market growth.

The following factors are likely to contribute to the growth of the APAC beer market during the forecast period:

• Increased Product Innovations

• Introduction of Innovative Marketing Strategies

• E-commerce to boost Beer Market Sales

• Growth in the Drinking Population

The study considers the present scenario of the market and its market dynamics for the period 2018−2024. It covers a detailed overview of several market growth enablers, restraints, and trends. The report covers both the demand and supply aspect of the market. The study profiles and examines leading companies and other prominent companies operating in the APAC beer market.

APAC Beer Market: Segmentation

This market research report includes detailed market segmentation by type, category, distribution, packaging, and geography. The craft beer segment constituted a small percentage of the APAC beer market. However, the growing demand for low-alcohol drinks and flavored beers is expected to drive the segment during the forecast period. The increasing awareness of various forms and styles of beer is also driving the APAC beer market. Although China has the largest market for craft beer in the APAC region, countries such as India, Thailand, and the Philippines are likely to witness growth during the forecast period. The mass-produced beer segment accounted for the highest market share of the APAC beer market. The Southeast Asian countries have witnessed a significant increase in beer sales due to the growing young population, changing preferences from spirits to beers, rapid urbanization, and increasing marketing activities aimed at the young community.

On-premise sales of beers are slightly less than off-premises sales in the APAC region. On-trade sales are higher in Vietnam, Singapore, South Korea, and Malaysia as consumers prefer to drink outside in social gatherings and parties. The off-premises sale of beers in APAC is expected to reach approx 49 billion liters in 2024. However, the emergence of craft beers is expected to merge a significant challenge for off-premise sales.

In the APAC beer market, premium beer categories are relatively underdeveloped than global standards. However, they are anticipated to grow faster than the overall market in the region. In China, the premium beer category has been resilient to the recent economic growth as consumers increasingly seek out for products that offer “more” in term of flavor, strength, and variety. The trend of premiumization is expected to increase the growth potential of the market in terms of value and volume. South Korea, Australia, and India are also witnessing the trend of premiumization. The mainstream beer segment, which comprises value or economy beers, has been witnessing sluggish growth in the APAC region. The introduction of craft and flavored beers and the increasing availability of premium beers in the market have led to the shift in consumer preferences. The demand for mass or value beers is expected to grow in India, Vietnam, the Philippines, Thailand, and Singapore, due to their price and affordability. The demand for premium beer products is expected to come from Australia, Japan, and China.

Packaging of alcoholic beverages needs to follow not only labeling regulations but also to attract consumers’ attention. Glass bottled packaging is a popular type and accounted for the largest market share. Metal cans are the fastest-growing segment for beer packaging. Metal cans, especially aluminum ones, are portable, lightweight, and convenient to store beverages and drinks. The China beer industry is shifting toward metal cans as they are considered portability and eco-friendly. Similarly, Thailand, Japan, Taiwan, South Korea, and Vietnam are the key market for aluminum cans in the APAC region.

Market Segmentation by Type

• Craft

• Mass Produced

Market Segmentation by Category

• Premium

• Mainstream

Market Segmentation by Distribution

• On-premises

• Off-premises

Market Segmentation by Packaging

• Glass Bottles

• Aluminum Cans

• Others

APAC Beer Market: Geography

China accounts for the largest beer market in the world. In term of volume, the market is almost twice the size of the US. China dominates the APAC beer market both in quantity and revenue. Although the volume sales of beer in China have declined in the last five years, the market is expected to witness growth during the forecast period due to macroeconomic trends and changing consumer attitudes. In terms of value and volume, the market in Japan is the fourth largest market globally, and the second-largest in the APAC region. The beer market in Japan is mostly stagnant; the craft beer segment is rapidly growing among Japanese consumers. The Australian beer market is relatively large and stable and is comparatively mature due to the high per capita consumption rate in the country. The beer market in Australia is one of the most profitable markets in the world due to the high per capita consumption and the rise in per capita GDP. India is one of the largest and fastest-growing beer markets in the APAC region. In terms of volume, the beer market in India is the fourth largest in the APAC region, with approximately 5% of the market share in 2018. The growing middle-class population in the country is expected to support the growth of the market during the forecast period.

Key Profiled Countries

• China

• Japan

• Australia

• Vietnam

• India

• Thailand

• Indonesia

• South Korea

• Philippines

• Taiwan

• Others

Looking for more information, Order a report now.

Key Vendors Analysis

The APAC beer market is highly competitive. These vendors are expected to continue dominating the APAC beer market due to their established presence, high reputation, stable capital funding, and high expenditure on promotions and expansion acclivities. The market vendors in the region are competing in terms of product quality, product innovation, and competitive pricing. Thus, consumer choices and preferences differ across regions and keep changing over time in response to geographical, demographic, and social trends, economic circumstances. Due to the highly competitive and volatile environment, future market growth mainly depends on the ability to anticipate, gauge, and adapt to the constantly changing market trends and successfully introduce new or improved products promptly.

Key Vendors

• China Resources Beer Holding Company

• Tsingtao Brewery

• Anheuser-Busch InBev

• Beijing Yanjing

• Carlsberg

Other Prominent Vendors

• Asahi breweries

• Guangzhou Zhujiang Brewery Group Co., Ltd

• Suntory

• Mohan Meakin

• Som Distilleries

• Kirin Breweries

• Sapporo

• Coopers Brewery

• SABECO

• Habeco

• Lotte Chilsung

• Hite Brewery

Key Market Insights

The report provides the following insights into the APAC beer market for the forecast period 2019–2024.

• Offers market sizing and growth prospects of the APAC beer market for the forecast period 2019–2024.

• Provides comprehensive insights on the latest industry trends, market forecast, and growth drivers in the APAC beer market.

• Includes a detailed analysis of market growth drivers, challenges, and investment opportunities.

• Delivers a complete overview of market segments and the regional outlook of the APAC beer market.

• Offers an exhaustive summary of the vendor landscape, competitive analysis, and key market strategies to gain a competitive advantage in the APAC beer market.

Jessica

Arizton Advisory & Intelligence

+1 312-235-2040

email us here