Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute: China Mortgage Rates Started to Rebound in June

Mortgage Rates Begin to Climb; As the Number of Banks with Mortgage Rates Unchanged or Upward Significantly Increased.

Jianpu Technology (NYSE:JT)

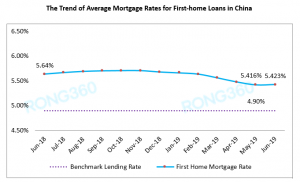

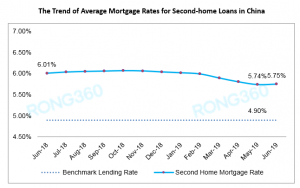

BEIJING, CHINA, July 12, 2019 /EINPresswire.com/ -- According to data from Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute, the average mortgage rate forfirst-home loans across the nation was 5.423% in June 2019, increasing by 0.7 basis points on a month-on-month basis, while the average mortgage rate for second-home loans increased by 1 basis points to 5.75% from May 2019. After seeing declines for six consecutive months, mortgage rates started to rebound. Among 533 bank branches nationwide monitored by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute, the number of banks with mortgage rates for first-home loans unchanged or upward significantly increased, while the number of banks offering lower mortgage rates declined from 108 to 44.Increasing Numbers of Fast-growing Second-tier Cities See Rising Mortgage Rates; Guangzhou, a First-tier City, Also Showed Signs of Rebounding

Multiple second-tier cities have seen signs of increasing mortgage rates. Following the trend in Qingdao, Nanjing and Chengdu, the average mortgage rate in Tianjin, Suzhou, Fuzhou, Ningbo and Nanning, increased in June, respectively, with high frequency of changes. Also, Nanjing experienced increased rates for the second consecutive month. In addition, some banks in Ningbo and Suzhou said they are using up their mortgage loan quota for the year and have considered suspending mortgage applications, while some second-tier cities saw rate drops this month from previously higher rate levels.

Among first-tier cities, Beijing and Shanghai saw slight drops in average rates mainly attributable to a decrease from a few banks. Shenzhen remained unchanged compared to the prior month, Guangzhou saw a rebound in mortgage rates, as 6 banks in this city have raised mortgage rates recently.

Harbin and Zhuhai Amongst Top 10 Cities with Lowest Mortgage Rates; Some Banks are Offering Benchmark Lending Rates for First-Home Loans

In June 2019, among first-tier cities, Guangzhou saw increasing mortgage rates and Beijing saw slight rate drops. As the level of rates in the two cities are still high in general, both were out of the Top 10 cities with lowest mortgage rate. Harbin and Zhuhai among second-tier cities, stepped in the Top 10 with lower mortgage rates this month as some banks within the two cities dropped their mortgage rates to benchmark lending rates levels. Although there are some banks in Zhuhai generally executing 5% above benchmark, they offer VIP clients benchmark rates.

Mortgage Rates Fluctuated Significantly and Frequently and More Cities Expected to See Rising Rates in the Future

The mortgage rates in June fluctuated significantly and frequently. Tianjin, Nanning and other cities that had temporarily lowered their rates for one month had raised them in the month of June. Some banks first raised mortgage rates, and later in the same month said that they have to suspend lending due to limited quota. While second-tier cities raised their mortgage rates, first-tier cities also show signs of rebounding mortgage rates. Guangzhou took the lead in making adjustments. Bank credit funds in the second half of the year were generally tighter than in the first half of the year, coupled with real estate regulation in popular cities, it is expected that more cities and banks will join the team of mortgage rate hikes.

PR

Rong360 Jianpu Technology

+86 10 8362 5755

email us here

Visit us on social media:

Twitter

LinkedIn

Facebook