Leprechaun Deposit High-Grade Main Zone Expanding with New Drilling: 4.24 g/t Au over 74.0m, 6.94 g/t Au over 24.0m & 10.03 g/t Au over 19.0m, Valentine Gold Camp, NL

Drilling Highlights:

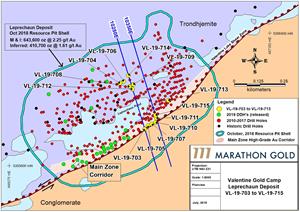

The summer drilling campaign at the Leprechaun Deposit continues to intersect new high-grade gold mineralization with abundant visible gold in the Main Zone corridor. This latest drilling has expanded the high-grade area within the Main Zone corridor to a strike length over 480 meters with a width of 30 to 100 meters and extending from surface to more than 300 meters depth, beyond the bottom of the Leprechaun pit (see Figures 1, 2 and 3). The new drilling along the Main Zone is oriented at high-angle to and through the shallow SW dipping en-echelon stacked QTP-Au veining and verifies the continuity of the high-grade gold zone from surface to depths greater than 300 meters, a fact particularly significant in areas of limited previous drilling along the northeastern portion of the Main Zone gold corridor.

-

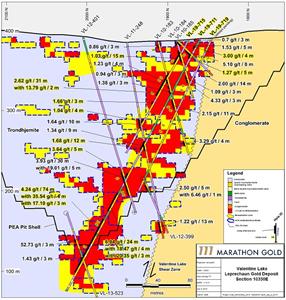

Main Zone: VL-19-711 intersected 4.24 g/t Au over 74.0 meters including 9.01 g/t Au over 2.0 meters, 35.54 g/t Au over 4.0 meters, 10.78 g/t Au over 3 meters and 17.10 g/t Au over 3.0 meters, as well as 6.94 g/t Au over 24.0 meters including 18.47 g/t Au over 4.0 meters and 20.35 g/t Au over 3.0 meters (Figure 2).

-

Main Zone: VL-19-715 intersected 2.62 g/t Au over 31.0 meters including 8.11 g/t Au over 2.0 meters, 13.79 g/t Au over 2.0 meters and 5.36 g/t Au over 2.0 meters, as well as 1.03 g/t Au over 15.0 meters near surface. This hole was drilled parallel and flanking drill hole VL-19-711, assisting in further defining the outer boundary of the high grade Main Zone. Assays are pending for VL-19-719 (Figure 2).

-

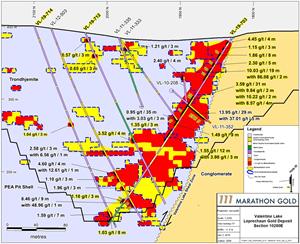

Main Zone: VL-19-703 intersected 10.03 g/t Au over 19.0 meters including 86.08 g/t Au over 2.0 meters and 3.59 g/t Au over 31.0 meters including 9.84 g/t Au over 2.0 meters, 10.22 g/t Au over 2.0 meters and 8.57 g/t Au over 4.0 meters (Figure 3).

-

Main Zone: VL-19-710 intersected 1.93 g/t Au over 53.0 meters including 19.64 g/t Au over 2.0 meters as well as 5.06 g/t Au over 5.0 meters and 4.42 g/t Au over 5.0 meters.

- Main Zone: VL-19-705 intersected 2.40 g/t Au over 11.0 meters and 1.68 g/t Au over 11.0 meters, VL-19-707 intersected 2.15 g/t Au over 12.0 meters including 6.56 g/t Au over 2.0 meters and VL-19-713 intersected 1.23 g.t Au over 10.0 meters .

-

Hanging Wall DDH’s, drilled towards the southeast, intersected significant gold mineralization in both the hanging wall and at deeper levels of the Main Zone corridor including 1.90 g/t Au over 18.0 meters including 5.13 g/t Au over 2.0 meters in VL-19-709, 4.53 g/t Au over 6.0 meters in VL-19-706, 4.55 g/t Au over 3.0 meters in VL-19-704, 3.39 g/t Au over 4.0 meters in VL-19-708, and 3.52 g/t Au over 4.0 meters in VL-19-712.

- The high-grade gold core of the Main Zone corridor of the Leprechaun Deposit now extends continuously for more than 480 meters along strike, extends from surface to a depth of more than 300 meters, and has a true width that ranges from 30 meters to more than 100 meters. Additional planned drilling is expected to increase the strike length of the high-grade core of the Main Zone corridor towards both the northeast and southwest.

- The 2019 drilling program is nearing completion at the Leprechaun Deposit. Following completion of this drilling program, the 3 drill rigs will move to the Marathon Deposit to complete a more than 17,000-meter infill and step-out drilling program.

- A 2,400-meter HQ core size geotechnical drilling program, using a fourth drill rig, will commence mid-July, focused on testing the open pit wall strength at both the Leprechaun and Marathon deposits. This work is being completed in advance of the PFS on schedule for release in Q1 of 2020.

TORONTO, July 11, 2019 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”) (TSX: MOZ) is pleased to announce continued excellent results from infill drilling along the Main Zone corridor of the Leprechaun Deposit. These drill holes, as well as the previously released 2019 drill holes collared along the upper edge of the Main Zone corridor (refer to Figure 1), are part of the series of planned infill drill holes that will cover a more than 800-meter strike length of the Main Zone corridor. These drill holes are designed to penetrate down through the shallow SW dipping, stacked gold-bearing QTP-Au veins which form the dominant vein orientation within the Main Zone corridor of the Leprechaun Deposit, increasing the width of the Main Zone corridor and improving the continuity of high-grade mineralization extending from surface beyond the bottom of the open pit into potential future underground resource development. The current drilling program is designed both to further confirm the geological model for the Leprechaun Deposit and to continue to upgrade Inferred resource material into the Measured and Indicated resource categories.

“These new wide intervals of high-grade gold at Leprechaun continue to expand the size and grade of the high-grade Main Zone while the lower grades in the hanging wall will assist in reducing the overall strip ratio of the Leprechaun open pit,” said Phillip Walford, President and CEO of Marathon Gold. “The 2019 Leprechaun drilling campaign, which is nearing completion, has succeeded in stitching together the high-grade areas of the Main Zone. Drilling has commenced at the Marathon Deposit and we look forward to the new Leprechaun Deposit resource estimation due in September.”

Mr. Walford added “The gold price is enhancing our project as well. The press release for the PEA released October 30, 2018 considers after tax of project payback, IRR and NPV with changes in gold prices in Table 4. The base price used for the study was $ 1250 USD per ounce of gold gives an after-tax project payback of 2.5 years, an IRR of 30%, and an NPV of $ 432 M USD with a 5% discount rate. The highest gold price used in the sensitivities in Table 4 was $ 1350 USD per ounce of gold and that gives an after-tax pay project payback of 2 years, an IRR of 36%, and an NPV of $ 616 M USD with a 5% discount rate. That is a marked improvement from the base case. With the gold price slightly above $1400 today, all of these economic parameters are higher yet.”

TABLE 1: Significant assay intervals, Leprechaun Deposit, Valentine Gold Camp

| DDH | Zone | Section | From | To | Core Length (m) | True Thickness (m) | Gold g/t | Gold g/t (cut) |

| VL-19-703 | MZ | 10280 | 8 | 12 | 4 | 3.2 | 4.45 | |

| 18 | 21 | 3 | 2.4 | 1.15 | ||||

| 27 | 35 | 8 | 6.4 | 1.86 | ||||

| 43 | 48 | 5 | 4.0 | 2.30 | ||||

| 52 | 71 | 19 | 15.2 | 10.03 | 4.32 | |||

| including | 61 | 63 | 2 | 1.6 | 86.08 | 31.78 | ||

| 97 | 128 | 31 | 24.8 | 3.59 | ||||

| including | 97 | 99 | 2 | 1.6 | 9.84 | |||

| including | 110 | 112 | 2 | 1.6 | 10.22 | |||

| including | 120 | 124 | 4 | 3.2 | 8.57 | |||

| 136 | 145 | 9 | 7.2 | 1.49 | ||||

| 151 | 163 | 12 | 9.6 | 1.55 | ||||

| including | 160 | 163 | 3 | 2.4 | 3.98 | |||

| 167 | 170 | 3 | 2.4 | 1.35 | ||||

| VL-19-704 | HW | 10230 | 313 | 316 | 3 | 2.7 | 4.55 | |

| VL-19-705 | MZ | 10300 | 35 | 38 | 3 | 2.4 | 2.20 | |

| 56 | 59 | 3 | 2.4 | 2.90 | ||||

| 93 | 96 | 3 | 2.4 | 1.25 | ||||

| 100 | 103 | 3 | 2.4 | 1.08 | ||||

| 128 | 139 | 11 | 8.8 | 1.68 | ||||

| 143 | 146 | 3 | 2.4 | 3.09 | ||||

| 173 | 176 | 3 | 2.4 | 1.25 | ||||

| 197 | 200 | 3 | 2.4 | 1.65 | ||||

| 205 | 209 | 4 | 3.2 | 1.17 | ||||

| 215 | 218 | 3 | 2.4 | 1.29 | ||||

| 223 | 234 | 11 | 8.8 | 2.40 | ||||

| 270 | 273 | 3 | 2.4 | 2.03 | ||||

| VL-19-706 | HW | 10250 | 256 | 262 | 6 | 5.1 | 4.53 | |

| 293 | 297 | 4 | 3.4 | 1.16 | ||||

| VL-19-707 | MZ | 10320 | 1 | 4 | 3 | 2.4 | 1.09 | |

| 18 | 30 | 12 | 9.6 | 2.15 | ||||

| including | 23 | 25 | 2 | 1.6 | 6.56 | |||

| 49 | 52 | 3 | 2.4 | 1.67 | ||||

| 57 | 60 | 3 | 2.4 | 6.27 | ||||

| 193 | 196 | 3 | 2.4 | 2.40 | ||||

| 203 | 206 | 3 | 2.4 | 1.18 | ||||

| 220 | 223 | 3 | 2.4 | 2.38 | ||||

| 256 | 259 | 3 | 2.4 | 3.40 | ||||

| 266 | 278 | 12 | 9.6 | 2.34 | ||||

| 351 | 354 | 3 | 2.4 | 2.87 | ||||

| VL-19-708 | HW | 10270 | 154 | 160 | 4 | 3.4 | 3.39 | |

| 175 | 178 | 3 | 2.6 | 1.79 | ||||

| 187 | 191 | 4 | 3.4 | 1.16 | ||||

| 250 | 253 | 3 | 2.6 | 1.30 | ||||

| VL-19-709 | HW | 10290 | 157 | 166 | 9 | 7.7 | 1.63 | |

| 203 | 221 | 18 | 15.3 | 1.90 | ||||

| including | 205 | 207 | 2 | 1.7 | 5.13 | |||

| 250 | 253 | 3 | 2.6 | 1.08 | ||||

| VL-19-710 | MZ | 10340 | 3 | 15 | 12 | 9.6 | 1.05 | |

| 19 | 24 | 5 | 4.0 | 5.06 | ||||

| 30 | 34 | 4 | 3.2 | 1.35 | ||||

| 58 | 61 | 3 | 2.4 | 1.19 | ||||

| 67 | 72 | 5 | 4.0 | 4.42 | ||||

| including | 70 | 72 | 2 | 1.6 | 10.22 | |||

| 91 | 144 | 53 | 42.4 | 1.93 | ||||

| including | 102 | 104 | 2 | 1.6 | 19.64 | |||

| 176 | 182 | 6 | 4.8 | 1.50 | ||||

| 195 | 199 | 4 | 3.2 | 1.35 | ||||

| 213 | 216 | 3 | 2.4 | 9.61 | ||||

| 222 | 226 | 4 | 3.2 | 2.43 | ||||

| 245 | 248 | 3 | 2.4 | 1.58 | ||||

| VL-19-711 | MZ | 10350 | 11 | 15 | 4 | 3.2 | 3.00 | |

| 22 | 27 | 5 | 4.0 | 1.27 | ||||

| 145 | 157 | 12 | 9.6 | 1.68 | ||||

| 191 | 196 | 5 | 4.0 | 3.64 | ||||

| 219 | 243 | 24 | 19.2 | 6.94 | ||||

| including | 229 | 233 | 4 | 3.2 | 18.47 | |||

| including | 239 | 242 | 3 | 2.4 | 20.35 | |||

| 256 | 330 | 74 | 59.2 | 4.24 | 4.19 | |||

| including | 261 | 263 | 2 | 1.6 | 9.01 | |||

| including | 271 | 275 | 4 | 3.2 | 35.54 | 34.69 | ||

| including | 296 | 299 | 3 | 2.4 | 10.78 | |||

| including | 318 | 321 | 3 | 2.4 | 17.10 | |||

| VL-19-712 | HW | 10280 | 161 | 165 | 4 | 3.4 | 3.52 | |

| VL-19-713 | MZ | 10430 | 15 | 18 | 3 | 2.7 | 6.69 | |

| 95 | 105 | 10 | 9.0 | 1.23 | ||||

| 111 | 116 | 5 | 4.5 | 2.19 | ||||

| 188 | 192 | 4 | 3.6 | 2.36 | ||||

| 210 | 214 | 4 | 3.6 | 4.05 | ||||

| 219 | 225 | 6 | 5.4 | 1.46 | ||||

| VL-19-714 | HW | 10280 | 144 | 147 | 3 | 2.6 | 1.04 | |

| VL-19-715 | MZ | 10350 | 19 | 34 | 15 | 12.0 | 1.03 | |

| 49 | 80 | 31 | 24.8 | 2.62 | ||||

| including | 52 | 54 | 2 | 1.6 | 8.11 | |||

| including | 56 | 58 | 2 | 1.6 | 13.79 | |||

| including | 61 | 63 | 2 | 1.6 | 5.36 | |||

| 89 | 92 | 3 | 2.4 | 1.66 | ||||

| 115 | 119 | 4 | 3.2 | 1.04 |

Three figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6d63de3b-ea27-4202-9297-2ecb72944c21

https://www.globenewswire.com/NewsRoom/AttachmentNg/77af7df0-086b-4503-9e1e-66b20e0964a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6ef896a-f15f-45f4-afeb-299f220f6e90

Please view the new video posted on our website www.marathon-gold.com showing layout plan for future mine site.

Acknowledgments

Marathon acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

Quality Assurance-Quality Control (“QA/QC”)

Sherry Dunsworth, M.Sc., P. Geo., Senior VP of Exploration, Marathon’s Qualified Person, has reviewed the contents for accuracy and has approved this press release on behalf of Marathon. Thorough QA/QC protocols are followed including the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, Newfoundland. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.10 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (80% - 90% of core length).

About Marathon

Marathon is a Toronto based gold company rapidly advancing its 100%-owned Valentine Gold Camp located in Newfoundland and Labrador, one of the top mining jurisdictions in the world. Marathon has confirmed the feasibility of the Valentine Gold Camp, which currently hosts four near-surface, mainly pit-shell constrained, deposits with measured resources totaling 1,166,500 oz. of gold at 2.18 g/t, indicated resources totaling 1.524,900 oz. of gold at 1.66 g/t and inferred resources totaling 1,531,600 oz. of gold at 1.77 g/t. The majority of the resources occur in the Marathon and Leprechaun deposits, which also have resources below the current open pit shell. Both deposits are open at depth and on strike. Gold mineralization has been traced down almost a kilometer vertically at Marathon and over 350 meters at Leprechaun. The four deposits identified to date occur over a 20-kilometer system of gold bearing veins, with much of the 24,000-hectare property having had only minimal exploration activity to date.

The Valentine Gold Camp is accessible by year-round road and is in close proximity to the provincial electrical grid. Marathon maintains a 50-person all-season camp at the property. Recent metallurgical tests have demonstrated 93% to 98% recoveries via conventional milling and an average of 65 to 72% extraction rates for 23 mm (1/2 inch) material via lower cost heap leaching at the Marathon and Leprechaun Deposits respectively.

To find out more information on the Valentine Gold Camp project, please visit www.marathon-gold.com.

| For more information, please contact: | |

| Christopher Haldane | Phillip Walford |

| Investor Relations Manager | President and Chief Executive Officer |

| Tel: 1-416-987-0714 | Tel: 1-416-987-0711 |

| E-mail: chaldane@marathon-gold.com | E-mail: pwalford@marathon-gold.com |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to Marathon Gold Corporation, certain information contained herein constitutes "forward-looking statements". Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "expects", "anticipates", "plans", "believes", "considers", "intends", "targets", or negative versions thereof and other similar expressions, or future or conditional verbs such as "may", "will", "should", "would" and "could". We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to those identified and reported in Marathon Gold Corporation's public filings, which may be accessed at www.sedar.com. Other than as specifically required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events, results or otherwise.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.