Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute: China Mortgage Rates Declined For Sixth Consecutive Month

Rong360 Jianpu Technology Inc. (NYSE:JT)

BEIJING, CHINA, June 20, 2019 /EINPresswire.com/ --Key Points:

- Mortgage rates have declined for sixth consecutive month, reaching the lowest level since 2018.

- Adjustments of mortgage rates among different cities vary greatly. While the mortgage rates has been slightly reduced in all first-tier cities, the situation in second-tier cities are different from one to another.

- Beijing and Guangzhou were off the top 10 list of lowest mortgage rates, while Urumqi, Shenyang and Kunming joined in.

- The downward trend of mortgage rates is coming to an end. In cities with a hot housing market, it may even start to rise.

- The price of the real estate market is stable.

Mortgage Rates Have Declined For Sixth Consecutive Month, Reaching The Lowest Level Since 2018

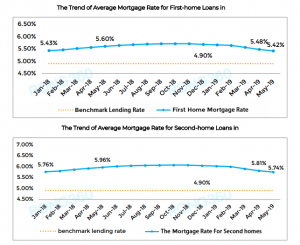

According to data analytics by Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Research Institute, the average mortgage rate for first-home loan in China was 5.42%, which is declined by 1.09%(6 basis point). The average mortgage rate for the second-home loan was 5.74%, which is 8 basis point lower than that of the previous month. After declining for six months in a row, the rates have fallen to the lowest level since 2018.

Nevertheless, among the 533 bank branches in 35 cities monitored by Rong360 Jianpu Technology Inc. (NYSE:JT), the number and proportion of banks with flat or rising level of first-home mortgage rates increased in May 2019. 108 banks reduced their rates, dropped by 3.38% than the prior month.

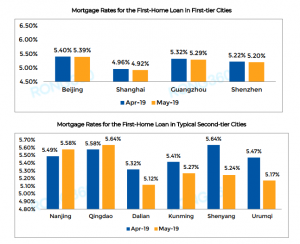

Adjustments of mortgage rates among different cities have obvious difference

The national real estate mortgage rate is reduced in May, but the adjustments of mortgage rates among different cities vary greatly. While the mortgage rates has been slightly reduced in all first-tier cities, the situation in second-tier cities are different from one to another. Among the second-tier cities, some whose interest rates had declined sharply in prior months have remained stable or slightly declined in May, others with relatively steady rates in prior months, such as of Urumqi, Kunming and Shenyang, have largely reduced the rates in May. Meanwhile, the mortgage rates of some second-tier cities have rebounded from the bottom. In addition, several banks are quietly raising the mortgage rates in cities whose average mortgage rates declined.

Beijing and Guangzhou Were Off the Top 10 List of Lowest Mortgage Rates

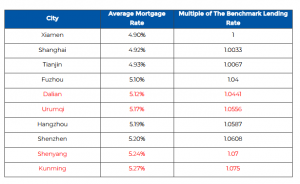

Generally speaking, the mortgage rate of first-tier cities is lower than that of second-tier cities. However, data shows that Beijing and Guangzhou were squeezed out of the top 10 list of lowest mortgage rates for first-home loans. Second-tier city Haikou was also out of it in May 2019. Instead, Urumqi, Shenyang and Kunming were included in, with the average mortgage rates of 5.17%, 5.24% and 5.27% respectively.

Still, Xiamen, Shanghai and and Tianjin enjoy the 3 lowest mortgage rates in China, with the average of 4.90%, 4.92% and 4.93% respectively. The rates of other seven cities were also below 5.30%.

Mortgage Rates Downward Trend Is Coming To An End, In Cities With A Hot Housing Market, the Rates May Even Start To Rise

The National Bureau of Statistics issued Sales Prices of Residential Buildings in 70 Medium and Large-sized Cities in April 2019. Two days later, the Ministry of Housing and Urban-Rural Development warned four cities over price rises, including Foshan, Suzhou, Dalian and Nanning.

On the background of real estate market regulation, it is generally believed that causal relationship exists between housing prices and mortgages rates. However, the data shows no such relationship.

In fact, increasing mortgage rates is not the only means to control the overheated investment in real estate. The main tone of national policy is still "houses are for living in, not for speculation", meanwhile, each city should take control measures in accordance with the local real estate market. From this perspective, it is easier to understand the data above.

Rong360 Jianpu Technology Inc. (NYSE:JT) concludes that this downward trend of mortgage rates is drawing to a close. It is likely that the average level of national mortgage rates may still decline in future, but more cities may maintain a steady rate, a few cities with overheated real estate market will even rebound.

Di Wang

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn