Spectrem Investor Confidence Indices Dip in March As Global Economic Indicators Weaken

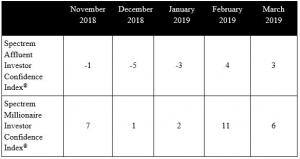

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

More Dovish Stance by U.S. Federal Reserve Negatively Affects Investor Sentiment

CHICAGO, USA, April 1, 2019 /EINPresswire.com/ -- With U.S. economic indicators showing new signs of weakness, and the European Union bracing for the possibility of a hard Brexit, U.S. investors signaled a more bearish sentiment in March, Spectrem Group reported today in its High Net Worth Insights newsletter. The Spectrem Millionaire Investor Confidence Index (SMICI®) dropped by five points in March to 6 following a significant jump in confidence reported in February, while the Spectrem Affluent Investor Confidence Index (SAICI®) remained in positive territory for the second consecutive month despite decreasing one point to 3. Both indices are now in neutral territory.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). March’s survey was fielded March 18-21, 2019, during which the Federal Reserve announced no plans to increase interest rates in 2019 due to a slowing U.S. economy.

During March, Millionaires expressed their intent to reduce their exposure to individual stocks, and plans to shift capital toward stock mutual funds, individual bonds and cash in the month ahead. Non-millionaires registered nearly opposite intentions across all categories, with the exception of real estate, where all investors expressed growing interest due to declining mortgage rates.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, displayed similar mixed messages. The overall Outlook remained steady at 21.60, despite a drop in the outlook for household assets and company health. This was the result of a significant increase in the most reactionary of the four components of the Spectrem Outlook, outlook for the economy, which broke into positive territory for the first time in six months.

“Following significant stock market declines toward the end of 2018, the first two months of this year have marked a period of solid recovery for investors,” said Spectrem President George H. Walper, Jr. “In March, markets remained strong, with volatility lower than in previous months. Investors continue to focus on possible outcomes of negotiations between the United Kingdom and the European Union over Brexit. And, while they are not necessarily pessimistic about the future, it’s clear that signs of slowing economic growth and the recent decision by the Federal Reserve to pull back from planned interest rate hikes are causing them to exert greater caution until global economic indicators can provide more definitive direction.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Marching Backward Again

• April 2019 Index Webinar

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

###

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here