Wealthy Investor Confidence Rebounds in February Along with Market Indices, According to Spectrem Group

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

The Spectrem Household Outlook, a measure of investor sentiment based on four key household financial components, also trends upward

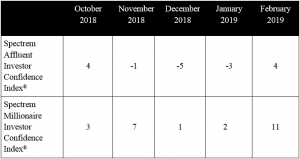

CHICAGO, USA, March 1, 2019 /EINPresswire.com/ -- U.S. wealthy investor confidence rebounded strongly in February following the December market downturn and the longest shutdown of the federal government in U.S. history in January, Spectrem Group reported today in its High Net Worth Insights newsletter. The Spectrem Millionaire Investor Confidence Index (SMICI®) grew by nine points in February to 11, and is now in mildly bullish territory for the first time since August 2018, while the Spectrem Affluent Investor Confidence Index (SAICI®) increased seven points to 4, its first time in positive territory since October.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). February’s survey was fielded February 14-19, 2019, and reflects the fact that the Dow Jones Industrial Average, which fell below 22,000 at one point in December, stayed above 25,000 through the first two weeks in February, nearing the 26,000 mark in the late stages of the survey fielding.

Rising confidence was reflected across nearly all investment classes, including stocks and individual bonds, among both non-millionaire and millionaire investors. Reflecting the overall improvement in investor sentiment, the percentage increase across non-millionaires and millionaires was nearly identical, with stock investing registering eight percent increases in each group.

Growing confidence was also reflected in Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components. The Outlook improved by more than 10 points to 21.10 overall, driven by a 13-point increase among millionaires and a seven-point increase among non-millionaires. The outlook on household assets, one of the four financial components measured, doubled among both millionaire and non-millionaire investors. Although the outlook for the economy, another of the four components measured, improved by almost nine points, it remained in negative territory for the fifth consecutive month after being above 23 in August of 2018.

“Wealthy investors appear ready to respond to recent bullish indicators following a period of high volatility late in 2018 and the December market plunge,” said Spectrem President George H. Walper, Jr. “Rising optimism about the outcome of U.S. trade negotiations with China, a more accommodative interest rate stance by the Federal Reserve and better-than-expected corporate earnings reports are providing a tailwind for investor confidence. However, continued political uncertainty over a divided Congress and the pending release of the Mueller report will continue to weigh on the minds of investors for the foreseeable future.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• All Is Forgotten – Investors Are Back!

• March 2019 Index Webinar

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.