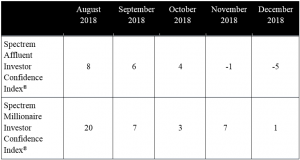

Spectrem’s Investor Confidence Indices Plummet to Lowest Levels in Years in Wake of December Stock Market Decline

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

Affluent and Millionaire investors cite weakening market conditions and political climate as most serious threats to achieving financial goals

CHICAGO, USA, January 2, 2019 /EINPresswire.com/ -- Significant declines in stock market indices during the first half of December took a significant toll on investor confidence in the month, according to Spectrem Group’s High Net Worth Insights newsletter. The Spectrem Millionaire Investor Confidence Index (SMICI®) and Spectrem Affluent Investor Confidence Index (SAICI®) sank to their lowest levels since January 2016 and August 2013, respectively. The SAICI fell from -1 to -5 in December, its first time recording negative numbers in consecutive months since January-February 2016, while the SMICI decreased from 7 to 1.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). December’s survey was fielded December 13-18, 2018, during which there were back-to-back days when the DJIA fell 300-400 points.

Although there was a slight increase among Millionaires planning to add to their investment portfolio in the coming month, interest in cash investing was the only category that increased in December, with declining interest in stock, stock mutual fund and individual bond investing resulting in the six-point drop in the SMICI.

While Non-Millionaires increased mutual fund investing for both stocks and bonds, with a sizable jump in stock mutual funds (from 17.2 percent to 26.6 percent), all numbers remain well below those recorded in September 2018. Despite a slight decrease from November in Non-Millionaires not planning to invest in the coming month, more than half (54.8 percent) of investors plan to stay on the investment sideline in January.

The overall Spectrem Household Outlook rose slightly to 14.50 in December from 13.80 in November, and there was a reported improvement in the outlook for household income and company health among almost all investors. However, the outlook for the economy, which is historically the component which reacts most directly to the stock market and investor confidence ratings, also fell dramatically across the board. Now standing at -15.60, the outlook for the economy is in negative territory for the third consecutive month, an occurrence last recorded in the middle of 2016.

“Significant financial market declines in the first half of December, which have continued, are negatively affecting investor confidence,” said Spectrem President George H. Walper, Jr. “Ongoing concerns about a slowing global economy, unresolved international trade issues, especially with China, and higher interest rates have made investors increasingly cautious about their capital allocation strategies for investing in the near-term.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Investor Confidence Mirrors Stock Market Slide

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here