Sabina Gold & Silver Grows the Llama Extension to Over 400 Meters Along Strike

Includes 17.96 g/t Au Over 4.60 m From Drill Hole 18GSE548B and 11.43 g/t Au Over 5.48 m From Drill Hole 18GSE546

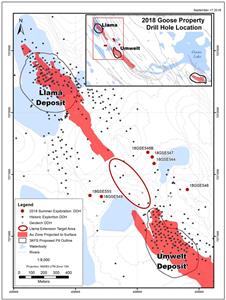

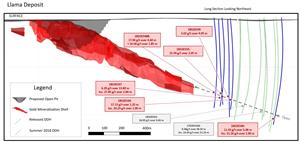

VANCOUVER, British Columbia, Sept. 18, 2018 (GLOBE NEWSWIRE) -- Sabina Gold & Silver Corp (SBB.T), (“Sabina” or the “Company”) is pleased to announce results from six drill holes completed at the Llama Extension zone where drilling has principally focused on expanding the up-plunge extent of the mineral zone towards the known Llama underground resource (Figure 1.0 & Figure 2.0) at the Company’s 100% owned Back River Project (“Back River” or the “Project”).

|

||||||||||

Five of the six drill holes completed during the current summer drilling campaign have successfully targeted the Llama gold structure over a strike extent of approximately 200 m up-plunge from the previous 2017 and 2018 drilling that returned a number of high grade intercepts over significant lengths (see previous news releases: Sept 5, 2017, April 2, 2018 & May 8, 2018). Selected significant values from these six drill holes are listed below in Table 1.0 and include 17.96 g/t Au over 4.60 m from drill hole 18GSE548B and 6.20 g/t Au over 13.80 m from drill hole 18GSE547. A single drill hole, 18GSE546, drilled 26 m along strike in the open down-plunge direction from current drilling, returned values of 11.43 g/t Au over 5.48 m and continues to demonstrate that the gold structure is open at depth. For a complete list of significant intercepts from these six drill holes see Table 2.0.

“Drilling continues to show that the Llama Extension zone has strong potential to add significant value as a growth option to the Back River development plan,” stated Bruce McLeod, President and CEO. “The Llama Extension zone has now been extended to over 400 m of strike length, located along the Llama gold structure approximately 150 m below the current Llama underground resource. From the drilling it appears the Llama open pit, underground and Extension zone are contiguous. It is notable that the Llama open pit is included in the current development plan while the underground resource is not and any new drilling success in this zone represents future opportunity for growth and expansion at Llama. The Llama Extension zone combined with the Llama underground resource, the Echo resource and additional potential new zones of mineralization such as the Nuvuyak target, offer a strong endorsement for the continued expansion of the mineral footprint within the Goose Project gold complex.”

| Table 1.0 – Selected Significant Drill Intercepts from Llama Extension zone drilling. | |||||||||||

| Hole Id | Area | Azimuth | Dip | Easting UTM |

Northing UTM |

Depth | From (m) |

To (m) |

Length (m) |

Au (g/t) |

Lithology |

| 18GSE544 | LL | 224 | -66 | 429637 | 7271589 | 673.70 | 600.95 | 602.20 | 1.25 | 17.13 | Silica Iron Formation |

| 605.60 | 606.60 | 1.00 | 24.23 | Argillite | |||||||

| 18GSE546 | LL | 225 | -65 | 429906 | 7271379 | 809.00 | 737.77 | 743.25 | 5.48 | 11.43 | Iron Formation |

| incl. | 742.25 | 743.25 | 1.00 | 51.26 | Iron Formation |

||||||

| 18GSE547 | LL | 225 | -63 | 429622 | 7271642 | 662.00 | 561.80 | 562.85 | 1.05 | 16.94 | Iron Formation |

| 565.05 | 565.75 | 0.70 | 19.76 | Iron Formation |

|||||||

| 601.50 | 615.30 | 13.80 | 6.20 | Iron Formation |

|||||||

| incl. | 602.55 | 603.55 | 1.00 | 54.56 | Iron Formation |

||||||

| 18GSE548B | LL | 225 | -64 | 429586 | 7271679 | 668.00 | 497.35 | 499.20 | 1.85 | 16.58 | Iron Formation |

| incl. | 498.40 | 499.20 | 0.80 | 35.76 | Iron Formation |

||||||

| 512.60 | 517.20 | 4.60 | 17.96 | Iron Formation |

|||||||

| 18GSE549 | LL | 61 | -70 | 429210 | 7271323 | 641.00 | 557.90 | 561.95 | 4.05 | 5.62 | Greywacke |

| incl. | 561.25 | 561.95 | 0.70 | 13.57 | Greywacke | ||||||

| 18GSE555 | LL | 60 | -58 | 429118 | 7271331 | 659.00 | Results Pending | ||||

| 617.95 | 620.00 | 2.05 | 15.34 | Silicate Iron formation |

|||||||

| incl. | 617.95 | 619.25 | 1.30 | 23.14 | Silicate Iron formation |

||||||

| Results Pending | |||||||||||

| *Intersection widths are drilled thicknesses and true widths are unknown at this time | |||||||||||

Llama Extension Zone

The Llama Extension zone is associated with the same host rock iron formation stratigraphy and gold structure that is host to the Llama open pit and the Llama underground resource. Llama underground Mineral Resource Estimate is comprised of 110,000 tonnes at 5.72 g/t gold for 20,000 ounces of gold in the Measured category, 752,000 tonnes at 8.72 g/t gold for 211,000 ounces of gold in the Indicated category, and 295,000 tonnes at 6.77 g/t gold for 64,000 ounces of gold in the Inferred category. Llama Extension mineralization, which has now been tested to within 150 m of the limits of the defined underground resource, has now been tested by a total of 14 drill holes over a strike length of 400 m. Drilling has partially defined a relatively tightly folded syncline structure, with a plunge of approximately 22 degrees to the southeast, intruded by a series of axial plane parallel quartz-feldspar dykes. The mineralization is described as disseminated to banded pyrrhotite and arsenopyrite with locally occurring visible gold, all coincident with quartz veined and sulphidized iron formation. A number of higher grade intersections have been drilled within the zone during 2017 and early 2018 and include 15.67g/t Au over 23.25 m in drill hole 18GSE530, 9.48 g/t Au over 38.55 m in drill hole 17GSE516B and 28.95 g/t Au over 5.65 m in drill hole 18GSE535.

Summer Drilling Progress

Drilling with three rigs continues, prioritizing the Nuvuyak target in an effort to expand the new discovery both up- and down-plunge. Two drill rigs are currently active on the Nuvuyak discovery while a third rig has been advancing additional regional target areas including a 1.5 km long untested stretch of prospective iron formation at the Boulder property.

Field exploration mapping, till geochemistry and geochronology programs have now been completed for 2018 in order to advance both the Goose Property and regional targeting initiatives. Sabina controls a series of highly prospective exploration properties over an area of approximately 80 km at the Back River project that are believed to have district scale synergies for future development.

| Table 2.0 – Complete List of Significant Drill Intercepts from Llama Extension zone drilling. | |||||||||||

| Hole Id | Area | Azimuth | Dip | Easting UTM |

Northing UTM |

Depth | From (m) |

To (m) |

Length (m) |

Au (g/t) |

Lithology |

| 18GSE544 | LL | 224 | -66 | 429637 | 7271589 | 673.70 | 600.95 | 602.20 | 1.25 | 17.13 | Silica Iron Formation |

| 605.60 | 606.60 | 1.00 | 24.23 | Argillite | |||||||

| 629.35 | 633.40 | 4.05 | 1.72 | Oxide Iron Formation |

|||||||

| 639.00 | 640.05 | 1.05 | 1.94 | Silica Iron Formation |

|||||||

| 18GSE546 | LL | 225 | -65 | 429906 | 7271379 | 809.00 | 383.58 | 384.40 | 0.82 | 1.22 | Iron Formation |

| 683.00 | 684.00 | 1.00 | 1.07 | Iron Formation |

|||||||

| 737.77 | 743.25 | 5.48 | 11.43 | Iron Formation |

|||||||

| incl. | 742.25 | 743.25 | 1.00 | 51.26 | Iron Formation |

||||||

| 747.50 | 748.50 | 1.00 | 6.84 | Iron Formation |

|||||||

| 18GSE547 | LL | 225 | -63 | 429622 | 7271642 | 662.00 | 505.55 | 506.00 | 0.45 | 4.93 | Iron Formation |

| 533.30 | 534.70 | 1.40 | 1.40 | Iron Formation |

|||||||

| 558.65 | 560.00 | 1.35 | 2.52 | Mixed Greywacke & Iron Formation |

|||||||

| 561.80 | 562.85 | 1.05 | 16.94 | Iron Formation |

|||||||

| 565.05 | 565.75 | 0.70 | 19.76 | Iron Formation |

|||||||

| 601.50 | 615.30 | 13.80 | 6.20 | Iron Formation |

|||||||

| incl. | 602.55 | 603.55 | 1.00 | 54.56 | Iron Formation |

||||||

| 629.45 | 633.95 | 4.50 | 2.97 | Iron Formation |

|||||||

| 18GSE548 | LL | 223 | -63 | 429587 | 7271680 | 26.00 | Abandoned - NSV | ||||

| 18GSE548B | LL | 225 | -64 | 429586 | 7271679 | 668.00 | 493.15 | 494.25 | 1.10 | 8.32 | Iron Formation |

| 497.35 | 499.20 | 1.85 | 16.58 | Iron Formation |

|||||||

| incl. | 498.40 | 499.20 | 0.80 | 35.76 | Iron Formation |

||||||

| 504.90 | 506.90 | 2.00 | 2.93 | Iron Formation |

|||||||

| 512.60 | 517.20 | 4.60 | 17.96 | Iron Formation |

|||||||

| 567.65 | 571.65 | 4.00 | 3.90 | Iron Formation |

|||||||

| 574.30 | 575.30 | 1.00 | 1.83 | Felsic Dyke | |||||||

| 576.30 | 578.20 | 1.90 | 3.66 | Iron Formation |

|||||||

| 581.00 | 589.00 | 8.00 | 2.02 | Iron Formation |

|||||||

| 595.00 | 599.00 | 4.00 | 2.11 | Iron Formation |

|||||||

| 18GSE549 | LL | 61 | -70 | 429210 | 7271323 | 641.00 | 501.90 | 502.90 | 1.00 | 4.10 | Iron Formation |

| 557.90 | 561.95 | 4.05 | 5.62 | Greywacke | |||||||

| incl. | 561.25 | 561.95 | 0.70 | 13.57 | Greywacke | ||||||

| 578.90 | 586.40 | 7.50 | 2.76 | Iron Formation |

|||||||

| 590.40 | 591.40 | 1.00 | 1.24 | Iron Formation |

|||||||

| 18GSE555 | LL | 60 | -58 | 429118 | 7271331 | 659.00 | Results Pending | ||||

| 611.20 | 612.20 | 1.00 | 1.27 | Argillite | |||||||

| 617.95 | 620.00 | 2.05 | 15.34 | Silicate Iron formation |

|||||||

| incl. | 617.95 | 619.25 | 1.30 | 23.14 | Silicate Iron formation |

||||||

| Results Pending | |||||||||||

| *Intersection widths are drilled thicknesses and true widths are unknown at this time | |||||||||||

Qualified Persons

The Qualified Person as defined by NI 43-101 as pertains to the Back River Project, is James Maxwell P.Geo, Exploration Manager, for the company.

All drill core samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs which include the insertion of certified reference materials, blank materials and duplicates analysis. All samples are sent to SGS Canada Inc. located in Burnaby, British Columbia where they are processed for gold analysis by 50 gram fire assay with finish by a combination of atomic absorption and gravimetric methods. Additionally, analysis by screen metallic processes is performed on select samples. SGS quality systems conform to requirements of ISO/IEC Standard 17025 guidelines and meets assay requirements outlined for NI 43-101.

Sabina Gold & Silver Corp.

Sabina Gold & Silver Corp. is well-financed with approximately C$62.4 million in cash and equivalents (Q2/18). The Company is an emerging precious metals company with district scale, advanced, high grade gold assets in one of the world’s newest, politically stable mining jurisdictions: Nunavut, Canada.

Sabina released a Feasibility Study on its 100% owned Back River Gold Project which presents a project that has been designed on a fit-for purpose basis, with the potential to produce ~200,000 ounces a year for ~11 years with a rapid payback of 2.9 years (see “Technical Report for the Initial Project Feasibility Study on the Back River Gold Property, Nunavut, Canada” dated October 28, 2015) (the “Study”). At a US$1,150 gold price and a 0.80 (US$:C$) exchange rate, the Study delivers a potential after tax internal rate of return of approximately 24.2% with an initial CAPEX of $415 million.

The Project received its final Project Certificate on December 19, 2017. The Project is now in the final regulatory and licensing phase expecting the Project’s Type A Water License prior to the end of the year.

In addition to Back River, Sabina also owns a significant silver royalty on Glencore’s Hackett River Project. The silver royalty on Hackett River’s silver production is comprised of 22.5% of the first 190 million ounces produced and 12.5% of all silver produced thereafter.

For further information please contact:

Nicole Hoeller

Vice-President, Communications

1-888-648-4218

nhoeller@sabinagoldsilver.com

Forward Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws (the “forward-looking statements”), including our belief as to the extent, results and timing of and various studies relating to engineering studies, infrastructure improvement activities, exploration results and permitting and licensing outcomes. These forward-looking statements are made as of the date of this news release. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, commodity prices, changing foreign exchange rates and actions by government and regulatory authorities and misjudgments in the course of preparing forward-looking statements. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with exploration and project development; the need for additional financing; the calculation of mineral resources and reserves; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; government regulation; obtaining and renewing necessary licenses and permits; environmental liability and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers or directors; the absence of dividends; currency fluctuations; labour disputes; competition; dilution; the volatility of the our common share price and volume; future sales of shares by existing shareholders; and other risks and uncertainties, including those relating to the Back River Project and general risks associated with the mineral exploration and development industry described in our Annual Information Form, financial statements and MD&A for the fiscal period ended December 31, 2016 filed with the Canadian Securities Administrators and available at www.sedar.com. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. This news release has been authorized by the undersigned on behalf of Sabina Gold & Silver Corp.

Bruce McLeod, President & CEO

Suite 1800 – Two Bentall Centre

555 Burrard Street

Vancouver, BC, V7X 1M7

Tel: 604-998-4175

Fax: 604-998-1051

http://www.sabinagoldsilver.com

Figure 1.0 accompanying this announcement is available at:

http://www.globenewswire.com/NewsRoom/AttachmentNg/c27ca113-5a54-4173-a9ee-704a00508dc4

Figure 2.0 accompanying this announcement is available at:

http://www.globenewswire.com/NewsRoom/AttachmentNg/49ab645d-7af3-497c-8d35-c1c8bf95ed9c