Spectrem Millionaire Investor Confidence Index Jumps to 16-Month High; Confidence Among Democrat Investors Booming

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

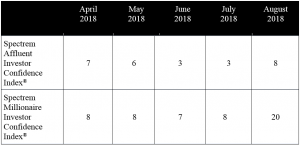

The SMICI, which measures changes in investment sentiment among investors with $1 MM or more in investable assets, rose from 8 in July to 20 in August, marking the largest one-month increase since January 2014. For the first time since April of 2017, and only the fourth time since 2006, the SMICI reached a rating of 20 or higher.

The dramatic month-over-month increase in the SMICI was driven in part by surging confidence among investors who identify as Democrat and Independent voters. These investors reported the strongest levels of renewed optimism among all investors surveyed, with Democrats’ SMICI reaching 18 and Independents’ SMICI increasing to 24; sentiment among both groups climbed dramatically from just 4 in the prior month.

At the same time, the SAICI, which tracks investor confidence among the 17 MM households in America with more than $500,000 of investable assets, rose from 3 to 8. While it is the highest rating for the SAICI since March of 2018, the index remains in neutral territory.

Among the individual components involved in the creation of the index, stock investing among Millionaires rose by 10 points to 41.1 percent, and individual bond investing rose by 3 points to 10.9 percent. Cash investing, which was running unusually high during the prior four months, dropped in August from 28.6 percent to 17.8 percent among Millionaires.

Non-Millionaires, on the other hand, were not as enthusiastic as their Millionaire counterparts, and dropped stock investing to 15.7 percent and stock mutual fund investing to 25.6 percent. Non-Millionaires also saw their percentage of investors not investing, meaning those who are not planning to increase their level of investment in the coming month, increase to 49.6 percent.

The Spectrem Household Outlook, a monthly measure of long-term confidence among investors across four financial factors impacting households, also saw an increase to 27.90, a 5-point jump. Millionaires again drove that increase, sending their outlook to 34.88 from July’s very low 25.40.

An improved outlook for the economy was responsible for the overall outlook improvement. Overall, the rating for the economy jumped almost 15 points to 23.20, and among Millionaires, it rose almost 17 points to 29.46.

“For several months, affluent investors have struggled to discern whether the accelerating strength of the U.S. economy should outweigh ongoing concerns over threats of impending global trade wars,” said Spectrem President George H. Walper, Jr. “The August index numbers show that wealthy investors have decided to put their cash to work rather than sitting idly on the sidelines while markets set new records and the U.S. economy continues to grow at the fastest pace in years.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Investors Finally Believe Again

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here