Using Waste CO2 In Greenhouses Helps CO2 Market Growth

LONDON, GREATER LONDON, UK, May 8, 2018 /EINPresswire.com/ -- The global market for carbon dioxide (CO2) is growing at nearly 4% year on year, a report from The Business Research company shows, a rate that has accelerated recently. One development that has helped growth is the supply by industrial gas companies of carbon dioxide emitted from industrial facilities to greenhouses. CO2 emitted from power plants and refineries is stored in local capacities and empty natural gas fields, and is then transported to greenhouses via pipelines. This process acts as an intelligent CO2 recycling solution and reduces the carbon footprint of greenhouses. For example, Linde collects carbon flow from the Shell oil refinery near Rotterdam, Netherlands, and supplies about 400,000 tonnes of CO2 to over 580 greenhouses across Rotterdam and Amsterdam. This saves the combustion of 115 million cubic meters of natural gas and avoids emissions of 205,000 tonnes per year of CO2, a volume that corresponds to the emissions of a Western European city of 150,000 inhabitants.

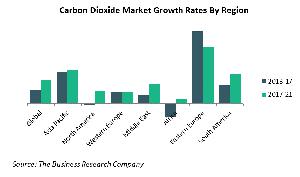

The proportion of the industrial gas market that the carbon dioxide segment represents is roughly similar round the world - 11% in China, 12% in the USA, for example. However, as the chart below shows, growth rates differ. Growth in Eastern Europe has been more than twice as fast as that in the second fastest-growing region, Asia Pacific, and though growth in Eastern Europe has declined it is still well ahead of that Asia Pacific even though that has increased.

Market Segmentations

Carbon dioxide is a segment of the industrial gas market.

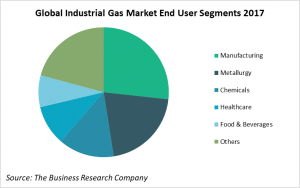

By end user industry, manufacturing is the largest global segment of the industrial gas market mainly due to manufacturing demand for industrial gases such as nitrogen and hydrogen. For instance, in the automotive industry nitrogen in combination with other welding gases is used to weld auto parts, frames, mufflers, and other components. Nitrogen is also used in high Reynolds-number wind tunnels, heat treating furnaces and autoclaves, and to help create strong and lightweight materials. Hydrogen is used in the manufacture of heat treating furnaces and parts. Metallurgy was the second-largest end-user segment, mainly due to the use of oxygen to increase combustion efficiency in both ferrous and non-ferrous metal production. CO2 is used as a shielding gas that prevents atmospheric contamination of molten metal in electric arc welding processes.

A Regulated Market

Many national and state governments have stringent laws associated with industrial gas manufacturing, storage and distribution to prevent accidents and contamination. For instance, the Current Good Manufacturing Practices (CGMPs) are regulations enforced by the US Food and Drug Administration to monitor the quality of medical gases. The CGMPs regulate proper monitoring and control of manufacturing processes and facilities in the medical gases industry. Some of these regulations increase operational costs, thereby affecting the profit margins of industrial gas manufacturers. Again, European Union safety regulation REACH (registration, evaluation, authorization, and restriction of chemicals) stipulates that all chemical substances must be registered. CLP (classification, labelling and packaging of substances and mixtures) is another European Union safety regulation that focuses on the safety of consumers and workers. Complying with these regulations tend to increase the operational costs of industrial gas companies, thereby affecting their profit margins.

Where To Learn More

Read the Industrial Gas Global Market Report 2018 from The Business Research Company for information on the following:

Markets Covered: Industrial gas market, nitrogen, hydrogen, oxygen, carbon dioxide, other industrial gases, chemicals market

Industrial Gas Companies Covered: L'Air Liquide S.A, The Linde Group, Praxair Inc., Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation

Regions: North America, Asia Pacific, Western Europe, South America, Eastern Europe, Middle East, Africa.

Countries: USA, China, Japan, Germany, Brazil, France, Italy, UK, Australia, India, Spain, Russia.

Time Series: Five years historic (2013-17) and forecast (2017-21).

Data: Industrial gas market size and growth for 7 regions and 12 countries; global regional and country industrial gases market size and growth segmented by type of gas - nitrogen, hydrogen, oxygen, carbon dioxide, other industrial gases; global, regional and country industrial gases market size and growth segmented by end user industry - manufacturing, metallurgy, chemicals, healthcare, food and beverages, other end users; global, regional and country industrial gases per capita consumption and market size as a percentage of GDP 2013-21; L'Air Liquide S.A, The Linde Group, Praxair Inc., Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation financial performance 2013-21; global chemicals market size and growth rate 2013-17 and 2017-21.

Other Information: PESTEL analysis, drivers and restraints, customer and operational insights, industrial market by country covering opportunities, industrial gas associations, investment and expansion plans, corporate tax structure and competitive landscape; Industrial gas market trends and strategies.

Sourcing and Referencing: Data and analysis throughout the report are sourced using end notes. Sources include primary as well as extensive secondary research.

Oliver Guirdham

The Business Research Company

+44 207 1930 708

email us here