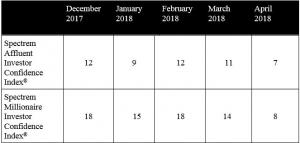

Spectrem’s Investor Confidence Indices Decline in April; Millionaires Pull Back in Wake of an Uncertain Economic Outlook

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). This month’s survey was fielded between April 19-23, 2018, when the DJIA opened at 24,711 and closed at 24,448.

Driving the decline in confidence among both Millionaire and Affluent investors are concerns over the long-term outlook for the U.S. economy, and uncertainty surrounding issues related to trade and foreign policy. These investors are acting upon these concerns by pulling away from the market.

Among Millionaires, interest in stock and stock mutual fund investing reached its lowest level since May 2017, while the number of Millionaires not planning to increase their investment levels in the coming month climbed to 31 percent. This marks the third consecutive month of higher percentages among those not adding to their investment amounts. While 34.7 percent of non-Millionaires indicated they would not increase investing in May, interest in stock mutual funds did rise slightly in April, displaying a bit more optimism than their Millionaire counterparts.

The Spectrem Household Outlook, which is a monthly measure of the long-term confidence among investors across four financial factors impacting a household, reflected the difference in confidence and optimism between Millionaires and non-Millionaires. While the overall Outlook dropped to 23.50, that was due to a 10-point drop among Millionaires to 22.48, a 10-month low, while non-Millionaires increased their outlook to 24.59, marking the first time since November the non-Millionaires had a rosier feeling about the economy than the Millionaires.

“Following six months of solid market gains, stock indices are in a holding pattern, as investors await greater clarity about the future direction of the U.S. economy,” said Spectrem President George H. Walper, Jr. “Millionaires and non-Millionaires often view current conditions differently, but it is unusual for the wealthier investors to be less optimistic. They appear to be cautious while the markets display an uncertain direction.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Index Falls as Stock Market Bounces

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here