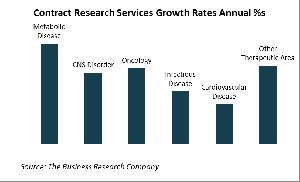

Metabolic Disease Contract Research Market is Growing at 17% A Year

LONDON, GREATER LONDON, UK, April 11, 2018 /EINPresswire.com/ -- The largest segment of the $44 billion contract research market is for clinical studies to develop therapies for cancer, but the smaller metabolic disease segment is growing much faster, a report from The Business Research Company shows.

The global market for clinical trial services to biopharmaceutical and medical device companies is forecast to grow at 12% year on year to 2021. That is an acceleration from its rate of 10% up to 2017 which raised its value to $44.4 billion.

Contract Research Organizations (CROs) are service providers that offer solutions in the conduct of clinical trials, including initial drug discovery solutions, toxicology studies, bio-analytical services, central laboratory functions, site monitoring, data management services, vigilance, bio-statistics, study and development program design and consulting, regulatory affairs and a variety of post-marketing surveillance services. Many pharmaceutical companies already outsource their R&D activities to CROs and it is expected that they will increase their outsourcing of drug development processes to CROs in future.

North America is the largest region for the production of CRO services, at $18.8 billion, while CRO consumption in North America is worth $20.8 billion or about 47% of the global total. The large market size can be attributed to the presence of a large number of pharmaceutical companies and extensive drug development activity in the region, especially in the USA. The production/consumption difference is due to the use of lower-cost offshore locations for some CRO activities by US pharmaceutical firms, although the majority of US outsourced activity remains within the country.

Declining growth in the pharmaceutical market is affecting the CRO industry, though not in an obvious way. Recently, the double-digit growth rates of pharmaceutical and biotechnology companies have been shrinking to single digits. Pharmaceutical and biotechnology companies have been confronted with the need to minimize their drug production and development costs which have forced most of them to evaluate cost-saving options such as outsourcing. Several companies in this sector have already adopted this strategy and outsourced their processes to specialist service providers such as CROs.

IQVIA is the largest player in the global CRO market with a 12.4% share, followed by Laboratory Corporation of America Holdings, ICON Plc, PAREXEL, and PPD.

Where to Learn More

Read the Contract Research Organizations Market Report from The Business Research Company for information on the following:

Markets Covered:

i) CRO's By Type of Services - drug discovery, preclinical studies, phase 1, phase 2, phase 3, phase 4 and others;

ii) CRO's By Therapeutic Area - oncology, cardiovascular disease, CNS disorder, infectious disease, metabolic disease and others.

Contract Research Organizations Mentioned: IQVIA, Laboratory Corporation of America Holdings, ICON Plc, PAREXEL and PPD

Countries: India, China, Japan, Australia, UK, Germany, France, Italy, Spain, Russia, USA, Brazil

Regions: North America, South America, Western Europe, Eastern Europe, Africa, Middle East, Asia Pacific

Time Series: Five years historic and forecast.

Data: Ratios of market size and growth to related markets, population, GDP, Contract Research Organizations Indicators Comparison.

Data Segmentations: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report are sourced using end notes.

Oliver Guirdham

The Business Research Company

+44 207 1930 708

email us here