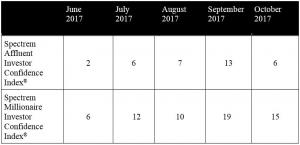

Spectrem Group’s Investor Confidence Indices Drop in October; Millionaires Double Down on Non-Equity Investments

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). This month’s survey was field between Oct. 16-18.

The dichotomy between Millionaire and non-Millionaire investment intentions is clear. The intention to invest in Stocks and Stock Mutual Funds among Millionaires continues to increase, reaching 45.7 percent in Stock Mutual Funds. Among non-Millionaires, the intention to invest in equities dropped from 24.6 percent to 19.2 percent in Stocks and 42.6 percent to 27.3 percent in Stock Mutual Funds.

Millionaires also expressed intentions to hedge their equity bets with an increase in Cash and Bond Mutual Fund investing, which caused the Millionaire index to dip. The increase in Cash investing doubled, from 14.8 percent in September to 30.5 percent in October.

The sentiment split between Millionaires and non-Millionaires is also apparent when looking at their respective plans to increase investments in the coming month. While 46.5 percent of non-Millionaires expressed no interest in increased investment, only 23.8 percent of Millionaires said the same. That is the lowest percentage of non-participation among Millionaires since August of 2015.

The Spectrem Household Outlook, which measures long-term confidence in four financial factors impacting a household’s daily economic life, also indicates that Millionaires feel much more bullish than non-Millionaires. The Outlook among Millionaires rose to 37.91, the highest level since 2011. The non-Millionaire Outlook dropped to 18.94, the lowest level since June of this year.

“Prospects for accelerating economic growth, tax reform benefiting the wealthy and strong earnings reports continue to fuel bullish sentiment among Millionaire investors,” said Spectrem President George H. Walper, Jr. “At the same time, however, less affluent non-Millionaires appear to be waiting to see if these market conditions are sustainable. And, while Millionaires continue to increase their equity investments, they are also hedging their risk through increased investment in Cash and Bond Mutual Funds.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Millionaires See Different Investment Future

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here