MacDonald Mines Exploration issued upside market valuation in research report as it advances gold project in Ontario

Several potential catalysts exist near-term with potential to result in $50 million market cap ($0.50 /share) for MacDonald Mines Exploration Ltd. TSX-V: BMK.

MacDonald Mines Exploration Ltd. (TSX:BMK)

NEW YORK, NY, UNITED STATES, October 2, 2017 /EINPresswire.com/ -- MacDonald Mines Exploration Ltd. (TSX-V: BMK) (US Listing: MCDMF) (Frankfurt: 3M72) is identified in a newly issued research report by Market Equities Research Group with several potential catalysts that exist near-term with potential to result in $50 million market cap ($0.50 /share) for BMK. MacDonald Mines Exploration Ltd. is advancing its Wawa-Holdsworth Gold-Silver Project located 25 km NE of Wawa Ontario, Canada.

The full research report may be found at http://sectornewswire.com/MarketEquitiesResearch-BMK-Oct-2017.pdf online.

Value drivers noted in the report include:

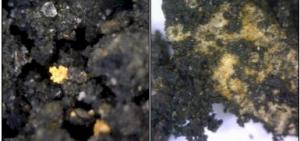

A) A New, More Rigorous Program to Produce Results: The initial discovery was of massive pyrite boulders, resulting in a successful search for a sulphur deposit by Algoma (1918-30). Discovery of gold at the Soocana vein system has resulted over time in several programs to duplicate those results, sometimes “prospecting with the drill.” The surface oxide sands were discovered in the 1980s, with some systematic follow up in 2002. We certainly can appreciate BMK’s highly disciplined approach: 1) a new appreciation for the property overall (recognition of the large 500m deformation zone), 2) an appreciation of the structure of the historic Soocana vein system, 3) attempting to systematically identify and delineate the oxide sands property wide along with an appreciation of the potential for very low cost startup and operating costs, 4) consolidating the property with the newly acquired Sage claims. Certainly, the new discovery of the Golden Goose prospect by simply ground truthing part of the property leads one to speculate on the potential for this property.

B) Current Program: As the trenching program continues at the known mineral sands / newly identified areas and the sonic drill program begins to determine depth down to and into bedrock, we should expect to see an initial resource with extraction potential using simple excavation methods / low cost concentration using a portable flotation mill. In 2017 and into 2018, we can also expect to see an assessment of how best to exploit the known hard rock targets and determine the potential for the property overall.

C) Value Proposition: The nature of this underexplored property combined with the expertise and discipline of BMK’s proven team bodes well for the future. With BMK trading at a market cap of only ~$8.6 million with multifaceted potential, there are catalysts on all fronts.

Potential value catalysts include:

A) Confirming and expand the oxide resource, determine extraction potential, and production decision.

B) Investigate hard rock targets.

C) Identify new oxide and hard rock targets.

Excerpt of conclusion noted in the report:

The Holdsworth and now Sage property are an interesting study in a situation where there is now an appreciation that there is gold potential throughout the property. In spite of this, we have had several past programs at Holdsworth (and it appears at Sage) that were geared to some rather limited areas, specifically the Soocana target in attempting to duplicate the 1930s results and a focus on the Reed target on the Sage property.

Interestingly, if there is something to a potential “trend” extending from the Reed target to the new Golden Goose showing, things could become very interesting. Certainly, with gold present from the north end of the property, and south through the Soocana vein system, and present again southward along the deformation zone through the Golden Goose and again southward to the Reed target, the limits of the gold system have not begun to be shown. Such potential can be affirmed with reference to the number of emerging world class deposits in the general area.

Therefore, in spite of the fact that these claims have a property history extending over virtually a 100 year history, this play is a combination of two different stories:

1) An increasing appreciation for the potential to realize strong cash flow from a very basic excavation and concentration operation related to the mineral sands.

2) Blue sky (and somewhat greenfield) potential from several high grade targets.

We would strongly add that BMK has only held this property since December of 2016 and has accomplished several milestones since then, and has a highly disciplined and focused strategy being executed by a proven exploration team, which we believe will add value for shareholders in the coming weeks and months.

The near-term mining production scenario developing from the surface and near-surface Oxide Sand Zones cannot be understated, it offers a quick pathway to cash flow and a way to advance the larger gold potential of the property without share dilution. The oxide sand zones appear amenable to MacDonald Mines simply obtaining a permit for mining aggregate. Market Equities Research Group extrapolating results to date over the known near-surface oxide zones alone projects potential near-100,000 oz (non 43-101) gold equivalent* (*using spot prices) appears readily extractable from mining the Oxide Sands.

Our 12-month price target for shares of BMK.V of $0.50/share appears attainable assuming 1) gold prices cooperate, 2) MacDonald Mines Exploration Ltd. defines an initial oxide resource, and 3) executes on a plan to cash flow. This will position the Company to advance the full potential of the project without dilution. This price target is based on a market cap of $50 million (in this number we have factored into it a possible nominal increase (up to ~25 million shares) in dilution to finance/facilitate objectives through to cash flow production scenario fruition). The Company is advancing quickly towards exploiting the potential of the Oxide Sands, a 2000 m sonic drilling program of the Oxide Sands initiated this September-2017 will assist in providing insight and possible catalysts for share price appreciation.

The full research report may be found at http://sectornewswire.com/MarketEquitiesResearch-BMK-Oct-2017.pdf online.

This release may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Fredrick William

Market Equities Research Group

8666209945

email us here