Major Shifts for Vendors in Financial Sustainability and Efficiency Index

Quarter over quarter Brocade, Ericsson and Nokia bump into a higher risk category

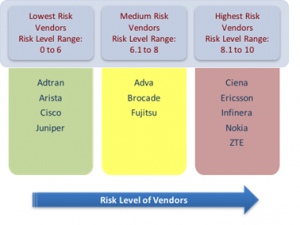

GILBERT, ARIZONA, USA, June 20, 2017 /EINPresswire.com/ -- ACG Research has released its 1Q 2017 Vendor Financial Index report, which delivers independent information about the sustainability of a vendor or company to help providers assess the risk of selecting the right vendor to meet their business requirements and to ascertain a risk level on the stability of the vendor regardless of technology innovations.Low-risk vendors for the quarter are Adtran, Arista, Cisco and Juniper. Brocade, which was in this category in 4Q, moved to the medium-risk. Characteristics of low-risk vendors include strong revenue outlook, high operating margins because of sales, solid gross margin and expense discipline, low debt dependency, and high receivable efficiency ratio. Medium risk vendors are Adva, Ericsson, Fujitsu and Nokia.

Adtran’s revenue was up by 20% YoY, driven by increased demand for higher bandwidth vectoring and fiber solutions. The company’s domestic revenues increased by 3% YoY and international revenues grew 97%. Adtran expects positive momentum associated with CAF and bandwidth expansion builds.

Arista’s revenue increased 38.5% YoY to $335.5 M, attributed to strong demand for new products, the 7500R and 7280R Series, and EOS platform. The company anticipates that Arista Universal Spine and Leaf R-series products are expected to gain momentum in 2017.

Cisco’s revenue of $12 B was up 2.6% QoQ because of stable performance in security and NGN routing. The company will focus on diversifying business by introducing software-based networking tools and security services and innovation across networking portfolio.

Juniper’s revenue grew 11% YoY. This growth was driven by revenue from cloud providers and strong demand for the QFX family of products. The company has a high operating margin of 13%. Its operating income increased 5% YoY.

Brocade, which has bounced between low and medium-risk categories, moved back into the medium-risk category this quarter, joining Adva and Fujitsu. Factors bumping the company back into the medium category include its operating margin dropping significantly from 12.6% in 4Q16 to 0.7% in 1Q17. The company’s operating income dropped to $4.3 M. Demand for data center networking equipment portfolio was slow because of intense competition.

Ericsson and Nokia moved to the highest risk category, joining Ciena, Infinera and ZTE. Although Ciena’s revenue grew 8.4% YoY attributable to strong APAC performance in India and in submarine applications, its product revenue decreased 13% QoQ to $507 M. Services revenue decreased 14.4% QoQ to $114.5 M. Ericsson’s sales decreased from $7.2 B in 4Q16 to $5.2 B in 1Q17 because of accelerated losses in IT and cloud and media, lower sales in OSS and BSS. Its North America revenue declined 10% and Europe and Latin America declined 16% YoY. Infinera’s revenue decreased 28.3% YoY. The company’s product revenues were $147 M, down 32% YoY. Infinera’s largest customer has slowed spending; additionally, the telcos' and MSOs' revenue also declined QoQ. Nokia’s revenue dropped 20% QoQ to $5.7 B because of weak networks business related to IP/Optical networks and fixed networks. ZTE continues to have difficulty in establishing presence in North America markets as well as persistent negative cash flow from investments.

ACG expects improvement in the carrier environment in 1H17 as customers accelerate investments in upgrading their network infrastructure.

For more information about ACG Research’s Vendor Financial Index service or other syndicated and consulting services, contact sales@acgcc.com.

info@acgcc.com

ACG Research

408-200-0967

email us here

About ACG Research