MacDonald Mines Exploration Ltd. advancing Gold laden zones, highly prospective for new discovery

The share price of MacDonald Mines is a coiled spring, the Company is advancing prime ground located next to two multi-million ounce gold deposits.

MacDonald Mines Exploration Ltd. (OTCMKTS:MCDMF)

Gold laden oxide sand zones appear amenable to MacDonald Mines simply obtaining a permit for mining aggregate.”

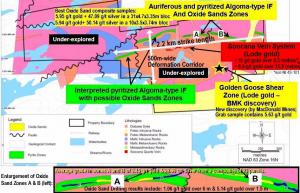

NEW YORK, NY, UNITED STATES, February 27, 2017 /EINPresswire.com/ -- Mining MarketWatch Journal is responsible for the content of this release. Macdonald Mines Exploration Ltd. (TSX-V: BMK) (US Listing: MCDMF) (Frankfurt: 3M72) Wawa-Holdsworth Gold Project is located 25 km NE of Wawa Ontario, Canada, uniquely positioned proximal Arogonaut's >6Moz Au Magino deposit property, and Richmont's >1Moz Au Island Gold Mine, along an underexplored extension of the prolific Michipicoten Greenstone Belt. The risk-reward characteristics are highly advantageous for investors establishing a long position in BMK.V as the current market cap (~$6M Canadian, trading at 11 cents/share) relative to the inherent value of MacDonald Mines' Wawa-Holdsworth Gold Property appears disproportionate; near-term share price catalysts exist as the Company is aggressively exploring to build on known gold values and leverage its exploration teams expertise and experience in the Wawa district gold camp.— Mining MarketWatch Journal

BMK.V is the subject of a Mining MarketWatch Journal review, full copy of which may be viewed at http://miningmarketwatch.net/bmk.htm online.

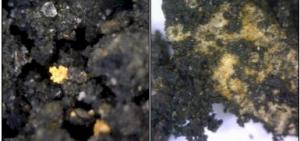

Oxide Sand Zones - Quick pathway to cash flow: Voluminous gold-bearing oxide sand (black sand) zones near surface have demonstrated potential for an immediate pathway to production/cash flow; e.g. 3.45 g/t gold and 29.99 g/t silver average grade from a composite of 23 panels, with preliminary metallurgical testing resulting in between 69% and 98.7% gold recoveries (without even crushing). The exploration team is now undertaking a program of mapping and quantifying these zones which were previously not mapped well and historically ignored for gold but characterized in the early-1900's as one of the best massive sulphide deposits in the country. There is the possibility of a 2.2 km strike length of gold laden Oxide Sands Zones over the auriferous iron formation (which acted as a trap for gold circulating in the system).

Oxide Sands can be treated like aggregate. Visible in the images of black oxide sands taken from the property is gold and some course grain quartz (which likely also contain gold). The oxide sand zones appear amenable to MacDonald Mines simply obtaining a permit for mining aggregate; backhoe the material, then crush and ball mill the material (to maximize recoveries), and transport the floured material to one of the several mills located within a few kilometers of the property. Works programs underway this winter and spring 2017 are geared towards affirming a voluminous and robust understanding of these Oxide Sands Zones -- the potential for a 6-bagger in share price appreciation from current price levels appears in order if exploration findings/results affirm what is suspected.

Three styles of gold mineralization exist on the 285 hectares Wawa-Holdsworth project, all part of the same gold system within the 500 metre-wide deformation corridor:

1) An oxidized cap at surface developed over a massive pyrite zone (Algoma Iron Formation) -- "The Oxide Sands",

2) The precursor to the Oxide Sands - a massive pyrite zone (Algoma Iron Formation) at depths -- "The Massive Sulphide", and

3) Lode Gold in traditional quartz veins -- "The Soocana Vein".

Large near-term exploration upside potential - Oxide Sands, BIF, and Load Gold Vein:

The exploration team has learned from other projects in the area that the alteration system associated in this land package is very large, something that people historically either didn't recognize, or know about, or chose to ignore, instead they would focus on the quartz veins. Banded Iron Formations (BIF) are hosted on the property, similar to other formations that were historically mined near Wawa. We know that when you put these type of rocks in an environment where gold bearing fluids are circulating they form very good traps for gold, and we know that BIF on this property are mineralized because the Oxide Sands are derived from the weathering of those banded formations. Additionally, localized drilling and samples in BIF have shown them to be gold bearing, historic samples were upwards of ~0.3 ounces/t.

Lode Gold in traditional quartz veins -- "The Soocana Vein": Almost all the historic drilling and work done for gold on the property was concentrated into a 700 m strike length associated with this 'Soocana' vein with very little efforts put into other gold plays on the property, apart from the Oxide Sands. The Soocana vein system is a shear zone with stacked auriferous quartz veins. A poor understanding of the shear system geometry by previous operators is obvious as drilling occurred in every direction with un-systematic sampling practice. Noteworthy historic (non NI 43-101 compliant) drilling intersections include 16g/t gold over 4.3 m, and 6.9 g/t gold over 15.8m and demonstrates the potential. At one time, in the 1930’s, the Soocana Mining Company Limited calculated a gold resource (historical non NI43-101) of 54,000 tons of material grading 0.556 oz/t (19.06 g/t), however the Soocana Vein was never meaningfully mined in any way, only a small pit scratched the surface in one spot from earlier on.

Proven exploration team that understands area geology: One of the most effective investment techniques for generating superior returns in exploration mining stocks is to follow quality/proven people to new ventures. The advisory and exploration team for MacDonald Mines has enjoyed exploration success in the Wawa gold camp. For example, Jean-Philippe Desrochers ,Ph.D., P.Geo., is part of the MacDonald advisory/exploration team -- he was Vice-President of Exploration at the Windfall Lake Gold Project (now owned by Osisko Mining) in its early days from 2005 to 2010 (then Murgor), and became Eagle Hill's Chief Geologist in 2010 before becoming Vice-President Exploration for Eagle Hill in 2013. Under his watch from 2005 - 2013 he took the Windfall gold project from conceptual to advanced stage with impressive resource that resulted in the Osisko buy-out. The advisory and exploration team of MacDonald Mines is looking to replicate that type of success here on the Wawa-Holdworth property now and believe their success in the area and intimate understanding of the geology provides a level of insight and expertise that was never previously afforded this prime land package.

For information purposes only and not a solicitation to buy or sell any of the securities mentioned; see http://miningmarketwatch.net/bmk.htm online for full TOU.

James O'Rourke

Mining MarketWatch Journal

8666209945

email us here