MyPass announces first round of institutional investment for its innovative financial payment and access technology

Integrates payment and access into one unique multi-vendor platform to enhance and simplify for a smarter buying experience

The user now has a smarter, hassle-free way to enjoy themselves without wasting time buying and presenting tickets or looking for the best deals.

FLORENCE, ITALY, September 19, 2016 /EINPresswire.com/ -- MyPass SRL, an innovative Italian fintech company, has announced that it has opened its first round of institutional investment that is targeted to raise over one million euros. Founded in May 2014,the first two years have been mainly dedicated to investing in research and development. The company has doubled its customer user base and its vendor base in the past two years, which provides MyPass with a proven track record in its home country of Italy. The new investment will be used to fund the company's expansion into the international market to become the global provider for integrated, smarter access and payment solutions. — Dr. Guya Paganini,CEO and CFO of MyPass.

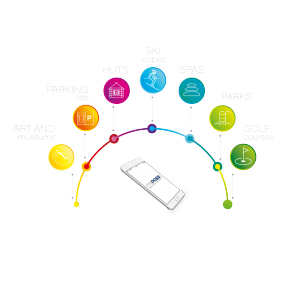

The company has perfected a novel financial technology (fintech) that provides an integrated payment and access platform for multiple vendors. This provides users with a convenient, secure means to not only pay for services such as cinema and museum tickets, parking and ski passes but also to have instant access to venues and facilities. This is done by the smartphone app either via Bluetooth® LE or by generating a smart, time-limited QR code that is scanned to provide access so that there is no longer any need to waste time queueing to obtain or present tickets.

"The Q1 2016 Fintech report by KPMG says that the fintech will likely become a more dominant player in the Venture Capital (VC) market globally," explained Dr. Guya Paganini,CEO and CFO of MyPass. "It notes that a key driver will be improving the buying experience for consumers. Currently, there are payment systems and there are access systems. We have now fused them together to provide a seamless, integrated, hassle-free, better buying experience that will be the next generation in the evolution of consumer fintech. This is therefore perfect timing to approach the VC market that is eager for exciting, innovative fintech solutions."

A key feature of the MyPass® technology is the intelligence built into the platform that enables vendors to join together to offer joint promotions. These packages of, for example, parking and cinema provide cross marketing opportunities to bring in new customers and reward existing ones by offering discounts and loyalty incentives. Not only does the customer save money but the vendor also benefits from instant payment as the MyPass technology works out each share and sends it immediately to the appropriate vendor.

Dr.Paganini added, "We initially started with passes for ski resorts but we realised that our smart technology enables us to offer a unique, 'pay and play' platform that can be extended to easily integrate a wide variety of vendors all on one single point of access via a smartphone app. The user now has a smarter, hassle-free way to enjoy themselves without wasting time buying and presenting tickets or looking for the best deals as the intelligence in our technology ensures that the user always gets the best rates. For example, consecutive daily usage is converted into a lower rate, multi-day pass and multi-vendor rates are similarly applied automatically. This enhanced user experience really appeals to customers who know that they are always getting the best deals from a growing range of vendors not only in their home city but also when visiting new ones by simply loading the appropriate city app. Vendors differentiate themselves and can easily win new business especially as all they have to do is provide the service and any discounts and we do the rest - they don't have to negotiate a whole set of agreements with other vendors."

MyPass uses the industry standard token system for payments so that the user's credit card details are securely stored by its partner banks and requests for payment from the card cause a token to be generated that is used in the MyPass network to effect direct and immediate payments to the vendors. Tokens can only be used for payments to vendors on the MyPass network making the solution extremely secure.

The MyPass appsare available for free from the Apple App Store and Google Play. The annual fee for all MyPass services is €10.

MyPass SRL www.mypass.cc

MyPass SRL, 131 Via dei Serragli, 50124 Florence, Italy. Email: info@mypass.cc

MyPass is a registered trademark of MyPass SRL. The Smarter Way to Access and Pay is a trademark of MyPass SRL.

All other trademarks are the property of their respective owners.

Nigel Robson

Vortex PR

+44 1481 233080

email us here