Venture Pulse Report - Q2 2015 Venture Capital Trends

VC-backed companies raised US$32B in Q2 due to mega financings and the rise of non-traditional investors, according to a new report from KPMG and CB Insights.

TORONTO, CANADA, July 29, 2015 /EINPresswire.com/ -- TORONTO ─ Venture capital (VC)-backed companies raised more than US$32 billion in Q2 2015 across 1,819 deals, bringing the total raised by VC-backed companies globally to a staggering $59.8 billion for the first half of 2015, according to Venture Pulse Q2 ’15 ─ the first in a quarterly VC report series from KPMG International and VC data company CB Insights. The surge in funding in Q2 represents a 49 percent increase over the first two quarters of 2014.In addition to key findings for Q2-2015, the comprehensive quarterly report examines the state of venture capital investment globally and regionally, including key trends and analysis.

“We are excited to work with CB Insights over the next two years to produce the Venture Pulse quarterly series,” says Dennis Fortnum, Global Head of KPMG Enterprise. “CB Insights has become a ‘go to’ source for robust data, insights and trends related to venture capital and emerging industries, and we are looking forward to working with them to provide a comprehensive look into venture capital investment around the world.”

Driving Growth: Bigger Deals and Mega-round Financing

Large deals are playing a major role in driving funding trends driven primarily by late-stage deals whose sizes are soaring worldwide.

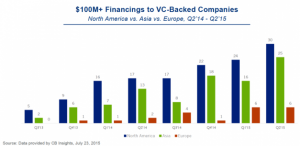

$100M+ mega-round financings to VC backed companies are also on the rise. In the first two quarters of 2015, there were more than 100 mega-rounds, including 61 in Q2 that cumulatively raised more than $16 billion in investment.

“Low interest rates combined with increasing participation by hedge funds, mutual funds and venture capital arms of large corporations means there is a tremendous availability of capital,” explained Brian Hughes National Co-Lead Partner, KPMG Venture Capital Practice, KPMG LLP in the US.

Anand Sanwal, CEO of CB Insights, commented: "Increasingly, VC-backed companies are staying private longer, and the best companies have a menagerie of funding options. This helped buoy Q2 2015 funding to levels last seen during the dot com era. Notably, the strength was global - from Berlin to Bangalore and the Bay Area to Beijing. While the funding environment is certainly frothy, we are seeing start-ups rapidly re-shape markets ranging from transportation to hospitality to healthcare."

North America Leads - but All Regions Wage Strong Gains

Regionally, North America, unsurprisingly, continues to lead global venture capital activity. With $37.5 billion invested in the first half of the year, funding is on pace to surpass 2014’s high by more than 25 percent.

In Asia, a mix of traditional venture capital sources mixed with hedge funds, private equity and corporates led to $15 billion invested into VC-backed companies in the first two quarters of 2015, putting Asia on track for 45 percent growth year-over-year.

Venture capital activity also spiked in Europe during the first half of 2015 with $6.6 billion invested. This puts Europe on pace to surpass 2014 totals by nearly 60 percent. Interestingly, late-stage deals in the region surged in Q2 reaching an average of $51.9 million.

“VC’s in Europe are reducing risk by investing at a later stage, “ said Arik Speier, Partner, Head of Technology, KPMG Somekh Chaikin in Israel. “In the past they invested in many companies in a wide portfolio and managed their own risk, now they are shifting strategy and investing in fewer companies and more money in each.”

Unicorn’ Investment Grows

Q2-2015 was a banner quarter for ‘Unicorns’ – venture capital backed companies with valuations in excess of $1 billion. Q2 saw the number of new Unicorns more than double to 24 over Q1’s 11 new Unicorns. This included 12 new Unicorns in the United States and nine in Asia. Among the quarter’s new Unicorns were Zenefits, Oscar Health Insurance and MarkLogic.

Corporate Investing Remains Strong

Globally, corporate investors continue to play a prominent role in having participated in almost 25 percent of total deals in the past four quarters. In Asia, corporate investors participated in 32 percent of financing deals to Asian VC-backed companies during Q2-2015. North America and Europe also saw meaningful contributions from corporate investors with 23 percent and 22 percent of VC-backed company financings, respectively, involving corporates.

Other Key Regional Findings:

North America

─ Early-stage deal sizes have grown in North America – from $4.6M in Q1 to $5.3M in Q2.

Europe

─ The UK accounted for approximately one-third of all funding and deals in Europe in Q2-2015.

Despite a rise in Series A deal share, overall early-stage deal sizes in Europe matched a five-quarter low at $3.2M in Q2’15.

─ Late-stage European deal sizes soared to new heights in Q2’15 hitting an average of $51.9M.

─ Tech companies dominated Europe VC-backed companies.

Asia

─ Since Q3’14, the average late-stage deal size in Asia has stood above $100M and as high as $285.9M in Q4’14. By way of comparison, the average late-stage deal in Asia stood at nearly 270 percent higher than in Europe in Q2’15.

─ Early-stage deals fell to $4.1M in Q2.

─ India experienced a big leap in VC-focused deal volume, increasing from 84 deals in Q1 to 122 deals in Q2, with funding doubling over the same time period.

─ Internet and mobile start-ups in Asia took a combined 82 percent of funding during Q2, compared to 65 percent and 74 percent in North America and Europe respectively.

*Note: all figures cited are in USD.

END

For more information, contact:

Jennifer Samuel

KPMG International

+1 416 777 8491

jsamuel@kpmg.ca

Michael Dempsey

CB Insights

212-292-3148

email us here